Life is full of second chances. During this time of global economic uncertainty and (hopefully temporary) depressed company valuations, Canadian business owners may have a second chance to revisit their estate planning strategy to determine if an opportunity exists to multiply the life-time capital gains exemption (“LCGE”) to family members.

Many reading this article will be very familiar with the LCGE. For those who are not, the LCGE enables business owners with the ability to dispose of up to $866,912 in share value in their small business on a tax-free basis. The LCGE is available to all Canadians and it is a cumulative lifetime exemption. This disposition can occur in an open market transaction (sale to a 3rd party) or in a deemed disposition upon death.

Take for example Bill who is the sole shareholder of ABC Auto Inc., which is an automotive repair business. If Bill sells his shares in ABC Auto Inc. to a competitor for fair market value (“FMV”) of $800,000, he may be able to receive the entire amount tax-free. Alternatively, if Bill were to suddenly die and not sell his shares, he would be deemed to have disposed of his shares for FMV just prior to his death. If Bill’s estate was to then subsequently dispose of these shares for the same amount, there would presumably be no tax paid on the sale as the deemed disposition on Bill’s death would increase the adjusted cost base (“ACB”) of the shares to their respective FMV. These examples of course assume that Bill’s shares in ABC Auto Inc. [1] qualify for the exemption and that he has not already used up his lifetime LCGE limit.

Twisting the facts ever so slightly, let’s assume that Bill has a son who is an aspiring mechanic and that ABC Auto Inc. grew quite rapidly over a 3-year period due to the successful opening of several new locations and the acquisition of some fleet contracts. ABC Auto Inc. has increased its share value from $800,000 in say 2017 to $2,400,000 in January 2020. As Bill was preoccupied with growing his business, little attention was paid to estate planning. As a result, the entire $2,400,000 in share value rests with him and, therefore, if Bill were to sell his shares or die, only $866,912 of the $2,400,000 would be received tax-free.

Fast forward a month or two and now, due to the COVID-19 pandemic, ABC Auto Inc. is experiencing a significant decline in sales. One of its major fleet customers has ceased operating and non-fleet volumes are down significantly as people stay home and reduce travel. Further, even if ABC Auto Inc. had the demand, the requirement for its employees to work at least 6-feet apart limits their ability to work on larger fleet vehicles. ABC Auto Inc. expects to incur a loss for the next year and it will take another two years to return to its pre COVID-19 results.

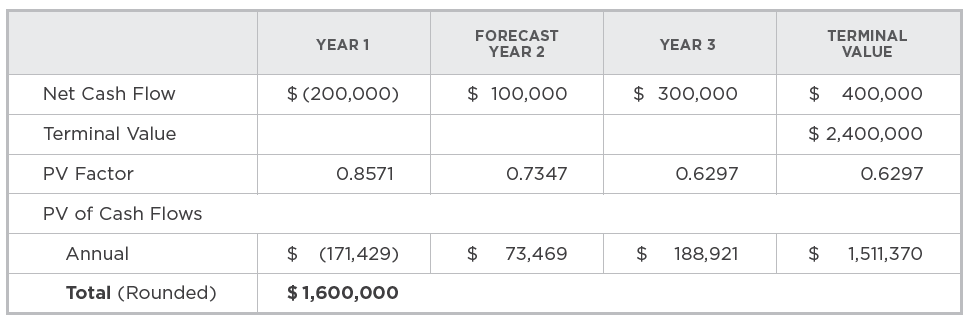

Whereas its pre COVID-19 valuation was determined based on a sustaining annual net cash flow of $400,000 and a multiple of 6x (or a discount rate of approximately 17%), its current share value might have been reduced to $1,600,000, determined (in this hypothetical scenario) based on a discounted cash flow approach as follows:

It may be advisable for Bill and his accountant to obtain a formal valuation report setting out the assumptions and rationale for arriving at this value.

Assuming neither Bill or his son have utilized any portion of their LCGE exemption and that Bill’s shares in ABC Auto Inc. qualify, it is possible for Bill to “freeze” his current share value at its current FMV of $1,600,000 by exchanging common shares for preferred shares with an equivalent stated value, and then have his son subscribe to newly issued common shares. On this basis, Bill has limited his tax bill upon disposition or death and the LCGE has been multiplied by having ABC’s future growth attributed to his son. If Bill has a spouse or other children, he may wish to further multiply the exemption by issuing them common shares as well, either directly or through a family trust.

Even if Bill had already undertaken an estate freeze prior to the COVID-19 pandemic, it may be possible to “thaw” a portion of his preferred share value in excess of the LCGE limit and transfer further growth using a similar approach. Every challenge is an opportunity. For business owners, the challenges caused by the COVID-19 pandemic presents a rare opportunity to revisit their estate planning objectives.

This article should not be construed as tax advice. Readers are cautioned to seek independent tax advice from a qualified tax professional before contemplating any measures described in this article. The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.

The rules surrounding qualified small business corporation shares (QSBC) are complex and are outside of the scope of this article. For more details, please refer to the following:

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/deductions-credits-expenses/line-25400-capital-gains-deduction/definitions-capital-gains-deductions.html#QSBCS