Background

The Insured is a fully-integrated energy company involved in oil & gas exploration, refining, petrochemical production and transport and marketing. Several explosions broke out in the Waste Heat Recovery Unit (“WHRU”) at one of the Insured’s Gas Separation Plants (GSP). This resulted in adverse impacts on the Insured’s various businesses including: i) Pipeline (upstream); ii) GSP (midstream); and iii) Olefin & Polymer (downstream).

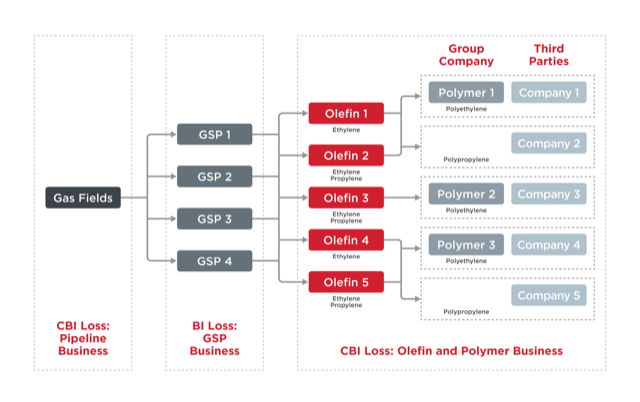

We were instructed to assess and quantify the claimed Business Interruption (BI) and Contingent Business Interruption (CBI) losses – see the block diagram below.

Impact on GSP Business – BI Loss

Whilst there was a significant decrease in the production levels at the damaged GSP, we observed that other unaffected GSP units noticeably increased production levels. Our analysis calculated the loss of production volume relating to the damaged GSP and compared it to the overall loss of production volume across all GSPs. Our measurement deducted the make-up achieved by the other unaffected GSPs in arriving at the net loss of production volume.

Interestingly, the proportionate usage of gas at the other GSPs was higher than that avoided at the damaged GSP, which eroded the savings in gas cost relative to actual throughput.

Given that the permanent repairs were unable to occur until approximately one year after the incident date, the Insured decided to install temporary heaters to increase production capacity from 50% to 100% – the loss of gross profit would have otherwise been larger. We compared the increased cost relating to additional LP fuel usage against the loss of gross profit averted and the Increase in Cost of Working (ICW) incurred was economic.

Impact on Pipeline Business – CBI Upstream Loss

Lower gas consumption due to the damaged GSP, which resulted in a loss of consumption to the GSPs as a whole, contributed to the loss of turnover for the Pipeline Business. Identifying the specific gas savings was one of the key determinants of the loss magnitude as gas was sourced from various wellheads, including group owned gas fields and gas fields owned by third parties. The Insured provided us with its simulation of what additional gas would have been purchased, had the loss not occurred, which contradicted our initial assumption that the Insured would have reduced more expensive sources, once annual offtake commitments were taken into consideration. The Insured explained that it was able to pass increases in gas purchase prices to its customers and the key determinant in the mix of the gas sources was to ensure that the Wobbe index (used to obtain constant heat flows from gases of varying compositions) of the combined gas feed to its customers met certain thresholds. After lengthy discussion, it was agreed that the gas savings would be based on the actual average gas purchase price in each month, but a further adjustment was made to account for uncertainty in the actual cost of gas that was saved.

Impact on Olefin & Polymer Business – CBI Downstream Loss

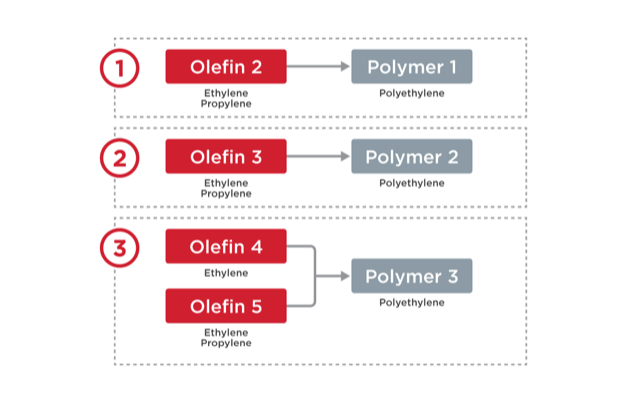

Each olefin plant was considered a separate insured entity (including its respective polymer plants) and was subject to a sub-limit per entity. Although all plants were owned by the same legal entity, this resulted from a merger of several legal entities in the recent past and the Insured struggled to properly split the accounting data by plant in a consistent manner over time. Further work would have been required to measure the losses in a precise manner, but we were able to work with the Insured to gain sufficient comfort that the losses would exceed the sub-limit (except in one case), based on limited available data.

We analysed the losses suffered by each entity using conservative assumptions. A consistent calculation was applied across all entities, including adjustment to feedstock projections during the months that planned maintenance work had been undertaken at one of the gas fields. We also valued the loss of production utilising the actual selling price appropriate to where we believe the loss of sales was sustained (domestic / export / inter-company sales). In order to ensure the consistency between the GSP and CBI loss estimates, our analysis adopted the same ethane and propane selling prices in the GSP loss calculation to calculate the saved feedstock costs at the individual olefin plants.

Conclusion

Our involvement in the loss measurement for all of the affected entities ensured that the calculation methodologies were applied consistently. Any change in our assumptions for one entity would have a knock-on effect on the other entities downstream.

We worked very closely with the adjusting team and the Insured to resolve a number of complex issues and were able to obtain a mutually agreeable claim settlement.

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.

CONTACT

CONTACT MDD

Our firm has over 80 years of experience working on assignments that span over 800 industries around the world.