Loss Event

As a result of a fire in its vacuum distillation unit, a refinery suffered a period of downtime in its crude unit, vacuum distillation unit, diesel and naphtha hydrotreaters and gasoline reformer. The refinery was able to process limited feedstocks during this period. To mitigate its loss, the refinery installed a temporary bypass of the vacuum unit, which allowed for roughly three-quarters of the normal throughput in barrels per day (bpd), until permanent repairs could be completed.

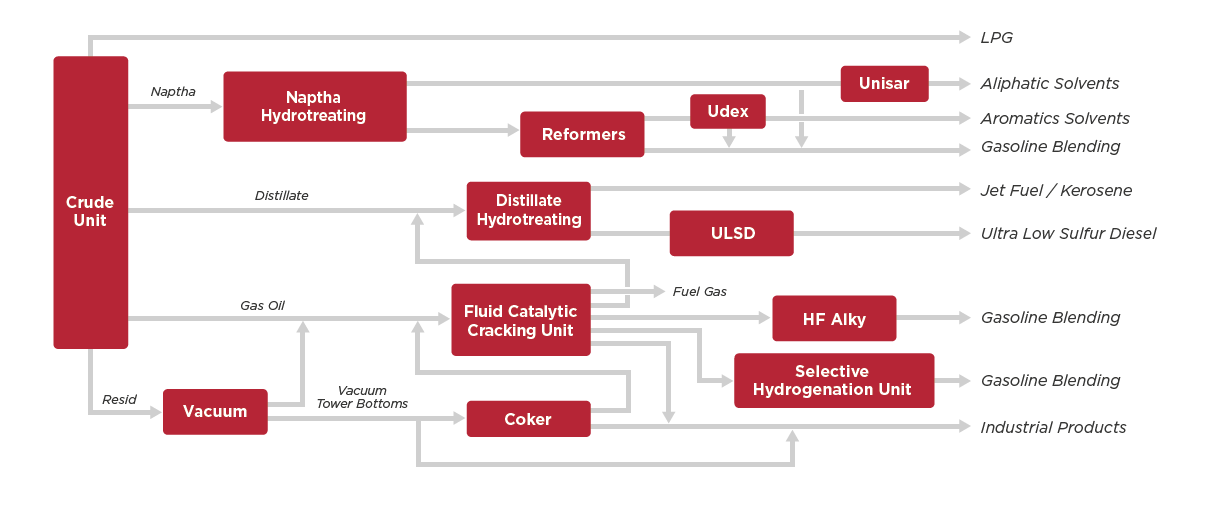

The process diagram below summarizes the refinery’s operation. Along with the FCCU, the VDU is a key unit in maximizing the gross refining margin, by breaking down heavier hydrocarbons into lighter more valuable hydrocarbons.

Key Considerations

- Seasonal gasoline blends.

- Potential spread benefits gained by the refinery resulting from its own reduced throughput.

- Incremental costs related to pipeline crude oil sold.

Background

The refinery processes approximately 200,000 barrels of crude oil per day. The majority of refined products produced at this facility are diesel fuel and seasonally blended gasoline. The crude slate (feedstock mix) favors using heavier Western Canadian crudes that are transported via pipeline. All refined finished products are sold to an internal marketing division, which is responsible for onward sales and distribution.

During the damages period, in order to continue maximizing its margin and downstream throughput, the refinery modified its crude slate to process lighter, sweeter crudes. Additionally, the refinery purchased incremental intermediate feedstocks, consisting of mostly sour vacuum gas oil, naphtha and light cycle oil. Also, as a consequence of the loss, the refinery sold off its committed purchases of crude oil, in the supply pipeline, that it was unable to use.

Measurement Considerations

MDD’s measurement was prepared under a standard gross earnings wording. The refinery’s damages consisted of business interruption losses related to lost barrel production and various additional expenses that were incurred to continue operations.

The plant had operated with a consistent level of historical throughput and lost volumes were identified with minimal difficulty. The measurement of incremental feedstock cost was also relatively straightforward, based on comparisons to historical feedstock purchases. Lastly, losses on the distressed sale of refinery-owned crude in the pipeline were measured with little issue. However, the determination of coverage for these losses was deferred to the insurers.

The measurement challenges related to this loss were primarily driven by changes in refined products market pricing, crude slate changes and pricing, and the impact of timing/trading gains on the actual cost of crude oil relative to its selling price.

Distressed Crude Sales

Because the refinery was unable to utilize crude oil in the pipeline for the downtime period, it chose to sell off a portion of its crude at a discount to avoid contractual penalties. The insured included in its claim the difference between its crude oil purchase price and its selling price to third parties. All parties involved participated in several discussions regarding the accounting aspects and coverage that may be afforded to these discounted sales. From an accounting perspective, the sale of this crude did not constitute a savings of raw material, it did not mitigate any of the insured’s business interruption loss and was not an incremental cost incurred to continue operating its facility.

Ultimately, a resolution was reached between the parties. Many refinery business interruption claims result in losses associated with feedstock commitments such as this, including distressed crude sales losses, demurrage and increased tank storage costs. While they clearly result directly from the damage and ensuing interruption to production, where they fit in terms of policy coverage is often hotly debated.

Although the interplay of above items created measurement challenges, MDD’s understanding of both the refining process and local markets played a key role in the resolution of this matter. Please stay tuned as several of the issues that arose in this case will be discussed in future technical briefings that will be published over the coming months.

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.

CONTACT

CONTACT MDD

Our firm has over 80 years of experience working on assignments that span over 800 industries around the world.