Introduction: Mitigating Fraud Vulnerabilities in Commercial Construction Projects

The commercial construction sector, characterized by complex supply chains, extensive capital investments, and multi-party engagements, presents inherent vulnerabilities to sophisticated fraudulent activities. Unmitigated fraud significantly erodes enterprise value through direct financial losses, compounded by downstream effects such as reputational degradation, litigation exposure, and potential regulatory sanctions.

This article presents a six-phase, empirically driven Fraud Risk Assessment (FRA) framework, meticulously engineered for the unique operational landscape of commercial construction projects. This roadmap details the methodological sequence required to establish, deploy, and sustain a robust, fraud risk management program, transitioning from a reactive to a proactive posture, with integrated defense mechanism.

Phase 1: Strategic Planning & Program Initialization — “Architecting” the FRA Mandate

The effectiveness of a FRA is directly tied to the strength of its foundational planning. This phase begins by clearly defining the assessment’s objectives and scope. Contractors must articulate the specific purpose for the FRA – whether it’s for regulatory compliance proactive threat detection, control optimization, or forensic preparedness. It’s also essential to align the FRA with the organization’s risk appetite, enterprise risk management framework, and relevant regulatory requirements, positioning it as a core element of the company’s governance strategy.

Next, a cross-functional FRA steering committee should be established, composed of experts from key operational areas. This includes leadership from the Project Management Office (PMO), who bring insight into project lifecycles and contractual workflows; finance and accounting professionals (who ensure transaction integrity and accurate reporting); supply chain and procurement specialists (who help identify vendor-related vulnerabilities); legal and compliance officers (who ensure adherence to laws and ethical standards); and internal audit personnel (who provide independent oversight and control validation).

Finally, the team should conduct a thorough review of the project’s characteristics to identify inherent risks. This involves analyzing project demographics such as size, budget, timeline, and stakeholder complexity-factors that tend to increase fraud exposure. Additionally, operational vulnerability mapping should be performed to pinpoint high-risk areas like subcontractor prequalification, material procurement, inventory management, change order processing, and progress billing reconciliation. This comprehensive approach ensures the FRA is tailored to the unique risk profile of each construction project.

Phase 2: Threat Vector Identification — Systemic Risk Enumeration

This phase or process focuses on the systematic identification and categorization of potential fraud schemes relevant to the commercial construction environment. It begins with structured fraud risk brainstorming and scenario development, using the Fraud Triangle-comprising pressure, opportunity, and rationalization as a diagnostic tool to uncover motivations and systemic vulnerabilities. Facilitated workshops with the FRA team help generate diverse perspectives and uncover fraud scenarios beyond common archetypes.

Next, contractors should catalog pervasive construction fraud typologies, including collusive bidding and bid rigging, kickback schemes, fictitious or inflated invoicing, asset misappropriation such as material diversion, payroll ghosting and timecard falsification, and manipulation of change orders to inflate costs or expand scope unnecessarily. To manage these risks effectively, a granular Fraud Risk Register should be developed. This register should include a clear description of each fraud scheme, a quantification of its potential financial, reputational, legal, and operational impact, a likelihood assessment (e.g., rare to almost certain), and an assignment of ownership to the individual or functional unit responsible for managing and mitigating the risk.

Phase 3: Risk Assessment & Prioritization — Quantitative and Qualitative Profiling

Quantitative and qualitative profiling entails evaluation of fraud risks to prioritize mitigation efforts based on their potential impact and likelihood of occurrence. A multidimensional approach is recommended, using tools such as a 5×5 likelihood impact risk matrix to assess each risk both quantitatively and qualitatively. Likelihood refers to the probability of a fraud scheme occurring, while impact measures the severity of its consequences across financial, operational, compliance, and reputational dimensions. Once risks are assessed, strategic prioritization is essential. Contractors should focus their control design and resource allocation on high-impact, high-likelihood risks, as these pose the greatest threat to project integrity. Additionally, prioritization should consider not only direct financial losses, but also indirect consequences such as reputational damage, potential contract termination, and increased regulatory scrutiny.

Phase 4: Control Environment Design & Implementation — Engineering Defenses

This phase centers on designing and deploying robust internal controls to prevent and detect fraud within construction projects. It begins with a baseline control effectiveness assessment, which involves inventorying all existing fraud prevention and detection controls and critically evaluating their operational effectiveness, coverage gaps, and alignment with control objectives. Once the current state is understood, the focus shifts to proactive control architecture development. This includes implementing a layered defense-in-depth strategy, such as enforcing segregation of duties to prevent single points of failure, automating vendor due diligence workflows, deploying real-time transactional analytics to detect anomalies, establishing secure anonymous whistleblower channels, and embedding contractual integrity clauses that address fraud and audit rights. To ensure accountability, each control should have a designated owner responsible for its performance and maintenance. A clearly defined role and responsibility matrix should also be established to outline who is responsible, accountable, consulted, and informed for each control activity, ensuring clarity and consistency across the organization.

Phase 5: Continuous Monitoring & Periodic Review — Sustaining Control Effectiveness

Fraud risk management in construction is not a static exercise; it requires continuous attention to ensure the FRA framework remains effective and adaptable. One key strategy is implementing Continuous Control Monitoring, which involves integrating advanced data analytics, machine learning, and artificial intelligence to proactively detect anomalies, trends, and red flags within project data. Contractors should also establish automated surveillance for high-risk transactions and vendors, especially those with frequent or unusual billing patterns.

In addition to monitoring, independent and iterative audits play a crucial role. These should include scheduled internal and third-party audits to evaluate control design and effectiveness, as well as unannounced audits in sensitive or historically vulnerable areas to enhance deterrence. Finally, the FRA framework itself must be dynamic. Contractors should mandate quarterly reviews of the fraud risk register and update it immediately following any major project changes, security incidents, or near misses. Lessons learned from actual fraud cases or control failures should be systematically incorporated to refine and strengthen the framework over time.

Phase 6: Stakeholder Education & Ethical Culture Cultivation — Human Firewall Reinforcement

The human element remains a critical component of any robust fraud prevention strategy in commercial construction. To strengthen this aspect, contractors should implement comprehensive stakeholder fraud awareness training. This includes developing targeted training modules tailored to various roles from field operatives to executive leadership and incorporating scenario-based learning with real-world examples and red flag indicators to improve fraud recognition and reporting. Equally important is fostering an intrinsic ethical framework within the organization. This involves clearly communicating and consistently enforcing a zero-tolerance policy for fraudulent conduct, while actively promoting anonymous reporting channels. These channels must be secure and trustworthy to encourage employees to report unethical behavior without fear of retaliation. Ultimately, integrity should be positioned as a core, non-negotiable organizational value.

Closing Thoughts:

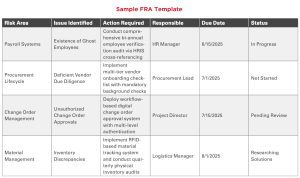

Practical FRA Template Snapshot for Implementation1

A structured template facilitates tracking and communication of identified risks and their mitigation statuses. Adapt the sample template below to suit the specific reporting requirements and preferences of your key stakeholders.

Financial Impact of FRA Implementation in Commercial Construction

FRAs are a strategic investment that can yield substantial financial returns for U.S. commercial construction firms. According to a Dodge 2023 report, fraud in non-residential construction projects accounts for up to 10% of total costs, equating to approximately $98 billion annually in the U.S. alone. These losses stem from procurement fraud, bid rigging, payroll theft, and compliance breaches, many of which are preventable through structured fraud risk management.

Further analysis shows that failing to implement proper project oversight and fraud controls can increase losses by 5-15% of aproject’s total budget. For a typical $8 million commercial project, this translates to $400,000 to $1.2 million in avoidable costs due to mismanagement, inefficiencies, and fraud exposure.2

Grant Thornton’s construction advisory experts emphasize that change orders are the number-one way owners overpay, often due to inflated pricing and sole-sourced negotiations under schedule pressure. Engaging independent cost estimators and quantity surveyors, key components of an FRA framework, can prevent slush funds and inflated costs, saving owners significant amounts.3

According to the National Insurance Crime Bureau (NICB), in 2023 the country experienced 28 separate billion-dollar weather and climate disasters, resulting in over $93 billion in total losses. Alarmingly, up to 10% of these losses, approximately $9.3 billion, were attributed to contractor fraud. This includes deceptive practices such as inflated pricing, substandard workmanship, and broken contractual promises. NICB emphasizes that contractor fraud costs Americans billions annually and contributes to rising insurance premiums. To combat this, the organization promotes public education through initiatives like Contractor Fraud Awareness Week and collaborates with insurers and law enforcement to raise awareness and prevent abuse.

Additionally, the Association of Certified Fraud Examiners reports that construction fraud cases have increased by 60% in recent years, driven by economic pressures and thin profit margins. Strategic vendor due diligence and continuous monitoring, both central to FRA implementation, help identify conflicts of interest, performance risks, and regulatory red flags reducing the likelihood of costly fraud incidents.

Who Is In Charge and When Are Updates Implemented?

A contractor’s FRA framework should be updated regularly to remain effective and responsive to evolving risks. Industry best practices recommend conducting formal reviews on a quarterly basis, with immediate updates triggered by significant changes in project scope, vendor relationships, regulatory requirements, or after any fraudrelated incident or “near miss.” This ensures the FRA remains aligned with current operational realities and emerging fraud typologies. The responsibility for creating and maintaining the FRA should rest with a cross-functional team, led by the PMO and supported by key stakeholders such as finance and accounting (for transaction integrity), procurement and supply chain (for vendor oversight), legal and compliance (for regulatory alignment), internal audit (for control validation), and executive leadership or a designated risk officer (for strategic direction and resource allocation). This collaborative approach ensures the FRA is not siloed but integrated into the contractor’s broader governance and risk management strategy.

The FRA as a Strategic Enterprise Asset and why it is worth the effort

Contractors are encouraged to implement a FRA program because it significantly enhances project integrity, financial resilience, and long-term viability. As outlined above and properly drafted and implemented FRA framework helps contractors proactively identify and mitigate fraud schemes such as bid rigging, kickbacks, and invoice manipulation. These threats can derail projects and trigger costly bond claims. By adopting a well-designed FRA, contractors demonstrate operational maturity and commitment to ethical governance, which improves underwriting confidence and may lead to better bonding terms. It also aligns with the surety’s interest in ensuring project completion and reducing the likelihood of default due to financial mismanagement. Furthermore, FRA implementation strengthens stakeholder trust through transparency and accountability and positions the contractor as a responsible business partner. Ultimately, the FRA becomes a strategic enterprise asset, embedding fraud prevention into the contractor’s operational DNA and supporting sustainable growth, making them ideal candidates for larger, more complex bonded projects.

Bonus Tip for Implementing a Fraud Risk Assessment Framework

Interviewing employees, managers, and owners is a critical component of a successful FRA implementation. These interviews serve as a qualitative intelligence gathering mechanism, enabling assessors to uncover latent risks that may not be evident through documentation or data analysis alone. One particularly effective technique is the use of open-ended, scenario-based questions that prompt respondents to reflect deeply on their operational vulnerabilities.

For example, asking, “If you could identify one risk on your project that keeps you up at night due to its potential impact on team safety, schedule delays, or financial loss, what would it be?” encourages candid responses rooted in lived experience. These insights often reveal high-severity risks that warrant immediate attention. Interviewers should be prepared to document responses thoroughly and translate them into actionable mitigation strategies within the FRA framework.

By Craig Mann

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.

As shown in the sample FRA template table. Keep in mind that this is a sample, and there are many possible snapshot versions. The snapshot should be tailored to include the information and format which is relative and understandable to the stakeholder audience you are sharing the information with. It is also recommended to use a structured tool for your risk management plans FRA. Once the FRA is completed, a project management program can work well to formalize the structure and control your risk management plan.

Construction Fraud: Prevalence and Financial Impact—CFSI Construction Loan Management

Battling Construction Fraud in a Fragile Economy—Grant Thornton