Discovery is under-way. The records are starting to flow. As you leaf through a box of documents just delivered, you pull out a stack of financial statements and, like so many other attorneys, you cringe. As you scan through the financial statements, you find yourself mentally analyzing the facts of the case and what useful data might be hidden within the numbers. Are there underlying financial issues that may require the assistance of an accounting expert? Is the possibility of financial fraud an element of the case that needs to be considered? In today’s world, keeping costs under control while achieving the best possible outcome for the client is crucial. As an attorney, having quick tools at your disposable to perform a cursory evaluation of the financial statements may help determine if it is time to engage the services of a forensic accounting expert.

Over the last decade, our daily news has been filled with stories of million-dollar corporate frauds and staggering Ponzi schemes. The question is: how prevalent is occupational fraud?

According to Dr. Donald R. Cressey’s Fraud Triangle1, people commit fraud when:

(1) they are under either financial or social pressure;

(2) have the opportunity to gain funds or perpetrate the fraud without being detected; and

(3) can rationalize their actions.

During periods of significant economic downturns and recessions, many companies find themselves struggling to stay in business. The recent banking crisis and the absence of funding added to the pressures these companies faced.This type of economic environment is ripe for fraud. Management may feel significant pressure to report positive financial results, contributing to their ability to rationalize questionable, if not fraudulent, accounting practices.

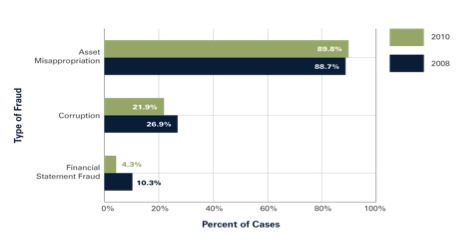

The Association of Certified Fraud Examiners (ACFE) categorizes occupational fraud into three main categories. The first category, asset misappropriations, involves schemes where the perpetrator steals or misuses the resources of an organization. The second category is corruption, which includes schemes such as bribery, extortion, and conflicts of interest. The final category of occupational fraud is financial statement fraud. These schemes involve the intentional misstatement or omission of material information in the organization’s financial reports. Financial statement fraud can be accomplished by recording fictitious revenues, concealing expenses or liabilities, and inappropriately inflating the value of assets. The following table, published by the ACFE in the 2010 Report to the Nations on Occupational Fraud and Abuse2, compares the frequency of the three categories of occupational frauds.

Occupational Frauds by Category (U.S.) — Frequency A

The sum of percentages in this chart exceeds 100% because several cases involved schemes from more than one category.

Asset misappropriation was by far the most frequently occurring occupational fraud in both the 2008 and 2010 study. Yet, the median dollar value of financial statement fraud is nearly ten times greater than that of asset misappropriation as the following table, also from 2010 Report to the Nations on Occupational Fraud and Abuse2, depicts.

Occupational Frauds by Category (U.S.) — Median Loss

The reasons to commit financial statement fraud are as unique as the individuals who perpetrate the frauds. Motivations run the gamut from desperation to plain, ordinary greed. The methods used to commit fraud are as equally varied. Common forms of financial statement fraud include overstating reported revenues and/or understating expenses. But how are these schemes accomplished and what questions might you ask when something looks out of the ordinary?

Overstating Revenues

This is a common form of financial statement fraud. Companies may manipulate the timing of when revenue is recorded, moving future revenue into the current reporting period. Treating merchandise out on consignment as an actual sale or recording fictitious sales are other methods used to overstate revenue. As you look at the financial statements and note a sharp increase in revenue you might ask some of the following questions. If revenue is increasing substantially why is the company still suffering from a lack of available cash? Has the accounts receivable grown inconsistently with the growth in sales? Is there a significant change in the ageing of accounts receivable? Has the company’s current year revenue increased significantly when compared to historical periods while the industry as a whole reported conditions of stagnant or declining revenue?

Understating Expenses

This is another common form of financial statement fraud. By understating expenses a company can show increased profitability. Like revenues, companies may manipulate the recording of expenses by delaying the reporting of an expense, which should be reported in the current period, into a future reporting period. Another method may be to classify expenses that should be included as cost of goods sold as operating expenses. While this does not inflate the net income of the business, it does improve the gross margin which could be a key indicator for that particular business or industry. Or the company may simply not record an expense that was incurred on its books at all. In cases involving the understatement of expenses, the following questions may be warranted: Why did a particular recurring expense decrease significantly from historical periods? Why did the gross margin improve when compared to prior years? What specific changes in the operations led to the improved gross margin?

Other schemes might involve improperly disclosing the nature of related-party transactions, maintaining more than one set of books, capitalizing normal repairs and maintenance costs, or underreporting the liabilities of the business. But it is important to keep in mind that the presence of red flags, such as those identified, does not mean there is fraud. A red flag is a signal that something is unusual or out of the ordinary. A red flag requires further investigation, analysis, and inquiry to determine whether there is a reasonable explanation, an error or something more.

So as you sit at your desk leafing through the financial records, what specifically should you be looking for?

First, consider the type of financial records in your hands. Were the financial statements prepared internally by management? Were the financial statements prepared by an outside accountant? Knowing if the financial statements were prepared internally or externally, lets you know what level of scrutiny the financial data has been subjected to by a third party.

If the financial statements were prepared by an outside accountant, the first page of the financial statements should be the letter from the accountant stating whether the engagement was a compilation, review, or audit. In the case of an audit, this letter is referred to as the audit opinion. A compilation is the lowest level of service that a CPA can provide for a client’s financial statements—the CPA expresses no opinions or assurances. A review engagement incorporates management inquiries and some analytical procedures that allow the CPA to express limited assurance on the financial statements. An audit engagement provides the highest level of assurance and the auditor is required to obtain reasonable assurance that the financial statements are reasonably stated.

When audited financial statements are provided, the audit report will state whether an unqualified opinion, a qualified opinion, or an adverse opinion was issued by the auditor. In situations where a qualified or adverse opinion was presented, the audit opinion should also disclose the reason(s) for issuing such an opinion.

Now it’s time to pull out your calculator.

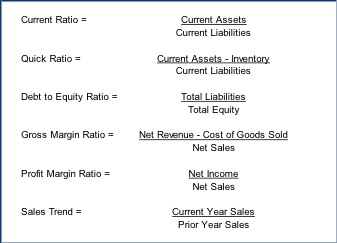

Financial ratio analysis measures the relationship between different financial statement amounts and is frequently used by bankers, investors and business owners to evaluate the strength of a company. This type of analysis can also be useful for detecting red flags, those potential indicators that something may be wrong. Financial ratio analysis is generally not helpful in detecting fraud involving minor amounts. For financial ratio analysis to be meaningful, several years of financial statements are needed. We analyze the financial ratios over a period of years to see if any significant changes have occurred which may be indicative of a problem. If significant changes are discovered, further analysis should be conducted on the relevant accounts. The box below contains some of the most common financial ratios, followed by a brief explanation of each of the ratios.

Current Ratio

Measures a company’s ability to meet its current liabilities using its short-term or liquid assets. The higher the current ratio, the more likely it is that the company can meet its current obligations.

Quick Ratio

The Quick Ratio is similar to the Current Ratio except inventories are excluded from current assets. Inventory is excluded to consider that not all companies can quickly convert their inventory to cash. The Quick Ratio compares assets that can easily be turned into cash to liabilities that will come due over the next 12 months.

Debt-to-Equity Ratio

This ratio is a measure of a company’s financial leverage, indicating what portion of equity and debt the company is using to finance its assets. This ratio is heavily considered in the lending community. The higher the ratio, the more challenging it will be for the company to raise additional capital through increased long-term debt; thus, the greater the risk assumed by the company’s creditors. Debt-to-Equity ratios that are less than 1.0 indicate the company is financed more by equity than by debt. Acceptable Debt-to-Equity ratios vary by industry; generally, the more capital intensive the industry, the higher the Debt-to-Equity ratio.

Gross Margin Ratio

Without sufficient gross margin, a company cannot pay its operating and administrative overhead costs. Generally, a company’s gross profit margin is expected to be stable. Significant fluctuations in gross margin may be caused by changes in pricing or rising product costs that are not passed on to customers. Significant fluctuations in a company’s gross margin ratio warrant further inquiry and analysis.

Profit Margin Ratio

Measures how much of every revenue dollar a company keeps in earnings. Declines in a company’s profit margin ratio suggest costs are not under control. If fraud is occurring, increased profit margins may signal fictitious revenues, while decreased profit margins may indicate false expenses have been recorded.

Sales Growth Index (Sales Trend)

This ratio measures the increase or decrease in sales from one year to the next. A declining sales trend suggests problems. Whether the decline is the result of the loss of a key customer, increased competition in the market or some other economic condition, it calls into question the strength and health of a company.

Financial ratio analysis is a useful tool for identifying changes in the relationships of financial statement accounts. Results from financial ratio analysis are even more meaningful when compared to other companies in the same industry. Industry data is available through numerous online resources. Bizstats offers free business statistics and financial ratios for various industries on their website.

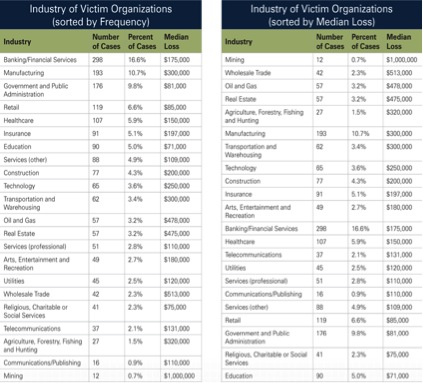

The ACFE, in the 2010 Report to the Nations on Occupational Fraud and Abuse2, looked at both the frequency of fraud and the median losses due to fraud by industry. The following table summarizes the ACFE’s findings:

Note: There was a small sample of only 12 cases in the mining industry, which may impact the reliability of the median loss data.

As you look through financial statements of a particular company, understanding the industry and the overall economic condition of that industry will aid you in your analysis.

Alright, you can put the calculator away.

There is one more area of the financial statements to consider. Often overlooked are the notes to the financial statements. The notes (also referred to as Disclosures or Footnotes) include additional information about the company, its accounting practices and methodologies, and other information that supports or explains amounts reported in the body of the financial statements. The notes often include useful details and insight into the organization that cannot be gleaned from the body of the financial statements. Specific notes to look for include the following:

Related-Party Transactions

Examples of related-party transactions include transactions between a parent company and its subsidiaries; subsidiaries of a common parent company; a company and its principal owners, management or immediate family members; and affiliates. Related-party transactions occur when a company engages in transactions in which one of the parties has the ability to significantly influence the policies of the other. Competitive or “arm’s length” transactions may not exist between related-parties. Enron, with its misuse of special purpose entities, and Tyco International, which forgave loans to its management team, were both well publicized financial statement fraud cases, involving related-party transactions.

Contingencies and Commitments

An entity may have gain or loss contingencies that are not disclosed within the body of the financial statements. Litigation, possible tax assessments, renegotiations of material contracts, and employment contracts are all items that may be disclosed.

Subsequent Events

Typically there is a time span of several weeks or months from the close of a company’s fiscal year until the financial statements are issued. The notes to the financial statements should explain any significant financial events that took place after the close of the year but prior to the issuance of the financial statements. Examples of subsequent events include the loss of a plant or inventories due to a fire or flood, pending business merger, loss of receivables due to a bankruptcy or casualty sustained by a major customer.

Long-Term Debt

The liabilities section of the balance sheet provides an aggregate total of liabilities. However, the notes to the financial statements provide additional information on the source of the financing, the future period costs and timing of the cash necessary for the repayment of debt.

Going Concern

When there is substantial doubt about the entity’s ability to continue as a going concern for a reasonable period of time, at least one year beyond the audit opinion date, a disclosure is made. Management’s plans to address the issues facing the company are also typically included in the disclosure. In 2008, Deloitte issued an audit opinion on General Motors that raised the issue of going concern.

In general, the notes or disclosures included with the financial statements provide additional background on the company, the accounting methods and practices and other details that support the body of the financial statements. If the case involves a publicly traded company, you may also want to consider obtaining Forms 10-K and 10-Q, which are filed the U.S. Securities and Exchange Commission (SEC) and are available to the public at no cost through the EDGAR database on the SEC’s website. Forms 10-K (annual) and 10-Q (quarterly) provide comprehensive information about a company’s history, organizational structure, subsidiaries and financial performance.

So the next time that box of financial statements enters your office, you hopefully have a few new tools to assist you in your analysis of the financial statements. Whether it is knowing what questions to ask when you see certain changes in the financial statements or knowing the specific areas of the financial statements to look to for additional information about the company (besides the bottom line) or performing a few calculations, these tools may help you evaluate the significance of the financial issues in the case.

By Suzanne Tarchala. Published in the TIPS Business Litigation Committee Newsletter.

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.

Cressey, Donald R. (1973). Other People’s Money: A Study in the Social Psychology of Embezzlement. Montclair: Patterson Smith

Association of Certified Fraud Examiners. (2010). Report to the Nations on Occupational Fraud and Abuse. Austin, TX: Author