Bitcoin. Ethereum. Litecoin. Dogecoin. NFTs.

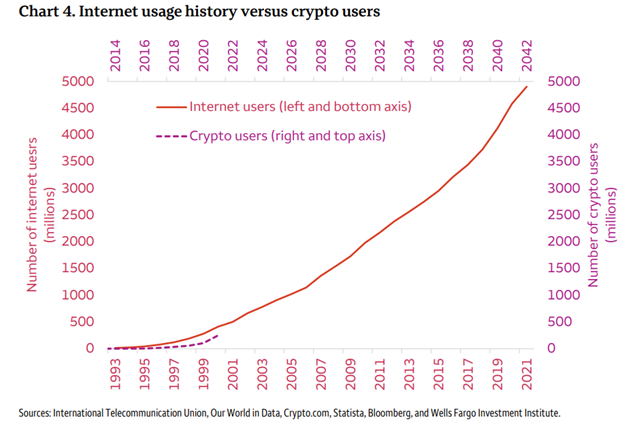

While they may seem like buzzwords or fads, cryptocurrencies or digital assets are experiencing a similar adoption pattern to the internet in the 1990s. In 1995, 14% of U.S. adults had internet access; by 2000, that rate increased to 46%.[1]

In the past 12 months, 13% of Americans had bought or traded cryptocurrencies, which means we may be entering the hyper adoption phase of cryptocurrencies.[2] This point is illustrated below as the number of crypto users are closely following the number of internet users:[3]

This rapid expansion has also led to a rise in fraudulent activity with digital assets (e.g. Ponzi schemes, money laundering, etc.).

In this article, we will provide some background on cryptocurrencies, share a few of the digital asset crimes that have occurred and outline several fraud prevention strategies and mitigation tactics to safeguard your assets.

Background

In 2008, someone with the pseudonym Satoshi Nakamoto published a white paper called “Bitcoin: A Peer-to-Peer Electronic Cash System”, which outlined the blockchain network. Blockchain is a form of record-keeping; it is a digital ledger. On January 3, 2009, Bitcoin (“BTC”) officially launched.[4]

On May 22, 2010, the first commercial transaction occurred when Laszlo Hanyecz purchased two Papa John’s pizzas for 10,000 BTC (on May 22, 2021, the 11th anniversary, 1 BTC = $63,000 USD; therefore, the two pizzas = $630M USD). In this transaction, the data would have been sent to Bitcoin’s decentralized network of nodes. Nodes verify, approve, and store data; once validated, the transaction is grouped with others to create a block and added to a chain of transactions (hence blockchain).[5] That block is encrypted and the transaction is permanent.

Since then, various exchanges have been created to buy and sell bitcoin and other tokens, such as Ethereum and Litecoin which have been developed as alternatives.

Cryptocurrency is a digital or virtual currency that exists in a secure database. It is an alternative to fiat, or government-issued, currency (e.g. Canadian dollar). Cryptocurrencies are also decentralized, which removes intermediaries (e.g. banks or monetary institutions). By eliminating the intermediary, fund transfers are comparatively faster to fiat transactions and are secured by using public or private keys.

Unfortunately, the use of these digital assets have become popular with criminals.

Scams

One of the largest Canadian crypto frauds involves QuadrigaCX, a cryptocurrency exchange, which the Ontario Securities Commission described as: “an old-fashioned fraud wrapped in modern technology.”[6] QuadrigaCX’s co-founder and CEO Gerald Cotton committed fraud by using QuadrigaCX’s trading platform to create a Ponzi scheme and misappropriate assets for personal use. On February 5, 2019, QuadrigaCX filed for creditor protection as over 76,000 clients were owed in excess of $215M CAD in assets.

According to the British Columbia Royal Canadian Mounted Police (“BC RCMP”), the number of fraud reports involving cryptocurrencies has increased exponentially from 734 in 2017 to 7,596 for the first 8 months of 2020. In the first 8 months of 2020, Canadians lost approximately $11M CAD from digital currency scams.[7]

In February 2022, two individuals were arrested in the United States for an alleged conspiracy to launder cryptocurrency that was stolen in 2016, currently valued at roughly $4.5B USD. It is alleged that these individuals used money laundering techniques such as creating fictitious identities, depositing stolen funds into various accounts on virtual currency exchanges and darknet markets and withdrawing the funds to distort the flow of transactions, etc.[8]

In addition to money laundering, fraudsters have been using “rug pulls”[9] of various NFT projects to scam over $2.8B from individuals in 2021.[10]

NFTs are unique crypto assets that cannot be replicated or replaced (i.e. NFTs claim to have a proof of ownership). NFTs include digital items such as images, videos, virtual land, etc. They are speculative and popular with sales reaching $25B USD in 2021.[11]

As an example, it is alleged that De’Aaron Fox, a professional basketball player for the Sacramento Kings, used the “rug pull” technique to siphon $1.2M from investors.[12] He backed a venture in December 2021 where fans could purchase a NFT with the promise of potential benefits such as tickets and merchandise; however, shortly after the money was raised, the project was cancelled (i.e. the investors’ assets were worthless).

Fraud Prevention Strategies

We have outlined several tips to consider when handling digital assets:

- Although cryptocurrencies such as bitcoin are a medium of exchange (i.e. these digital coins can be used to obtain other goods and services), be aware that Canadian government agencies or police do not accept payment of cryptocurrency, gift cards, etc.

- As with any potential investment, especially speculative investments such as NFTs, research and perform your due diligence to assess your risk tolerance and analyze the project’s feasibility.

- To protect your digital assets, it is recommended that you use a cold wallet (i.e. a hardware wallet that is not connected to the internet), use secure internet when making cryptocurrency transactions, maintain multiple wallets to diversify your portfolio and change your passwords to these accounts periodically.[13]

- Be careful when transferring crypto assets. As there is no intermediary, it is unlikely that a transaction (whether by mistake or a fraudulent error) will be reversed.

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.

- ibid

- Chart 4 is from Wells Fargo Investment Institute’s Special Report on Understanding Cryptocurrency – February 2022: https://saf.wellsfargoadvisors.com/emx/dctm/Research/wfii/wfii_reports/Investment_Strategy/cryptocurrency020722.pdf

- ibid

- A “rug pull” is a scam where developers initially pump or hype up a NFT project to draw more investments from individuals. Then the developers abandon the project and removes any liquidity (i.e. the investors lose all of their money).

Richard Tam

Richard Tam