Depending on where you are located, you are likely to experience some sort of “weather disaster season,” such as hurricane season, cyclone season, tornado season, earthquake season, or wildfire season. I live in California where we have earthquake season, which is year-round, and in the last 7 years, I have become increasingly familiar with wildfire season.

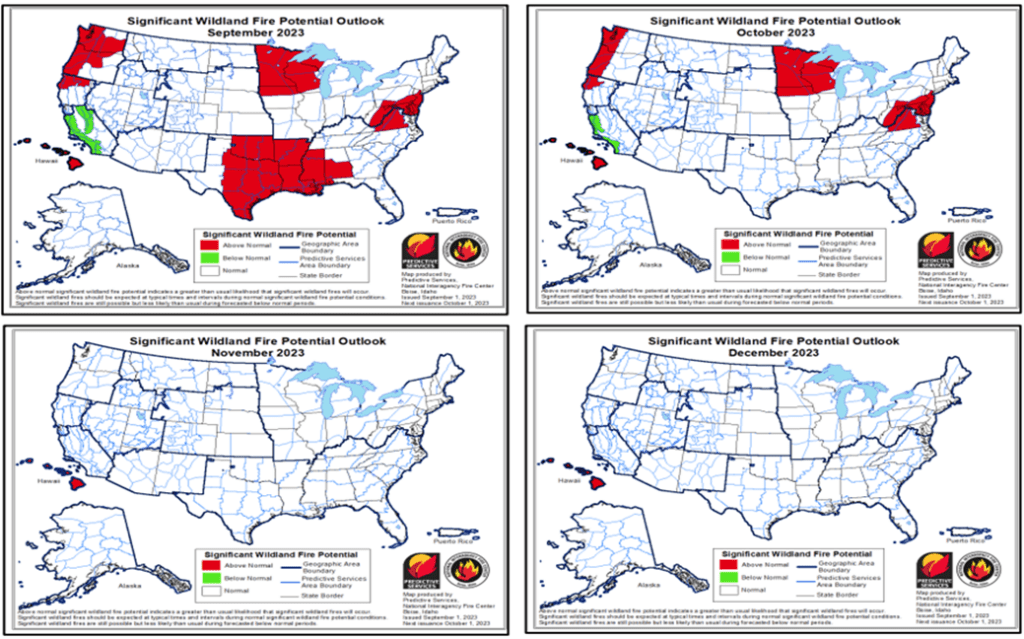

The National Interagency Fire Center (NIFC) issued a report on September 2, 2023, which shows above-normal wildfire potential for the rest of the wildfire season for various parts of the country due to hot and dry conditions in some areas and long-term drought in others. In California, it finally rained and the NIFC stated we should have lower-than-normal wildfire potential for the rest of the season.[1].

Although I have been in forensic accounting for 25 years and have seen the impact of hurricane season a multitude of times, only in the last 7 years have I really seen the impact of wildfire season.

With a hurricane, people often have warning. The weather service sees the hurricane coming and informs people to the best of their ability, of the likely impact of the storm. The hurricane does not normally hang around for days at a time. When deemed safe, people have access to their property to determine the extent of the damage, what could be saved, and what needed to be leveled or repaired.

When a wildfire hits, often there is no time for preparation. The weather service has not been covering the fire for days trying to predict its trajectory. The fire starts and can move at incredible speeds. I remember listening to a news report related to the Camp Fire in Paradise, which stated the fire spread the length of an American football field in a matter of approximately 60 seconds.

With a wildfire, it can be days or weeks until the fire is contained. People are evacuated and left wondering what they will find when they are allowed to return. The wildfire can change direction quickly, as embers are carried by the wind, such that one structure will be burned, and the neighboring building is left unscathed. With a fire, some structures have smoke damage, some have water damage from firefighting activity, and some are burned to the ground with not much evidence left of what was inside.

Depending on the extent of the damage from the fire, we have seen issues such as:

- The inability for insureds to reopen due to contaminated water supplies, as was seen with Benzene in the Camp Fire in Paradise

- Increased periods of repair due to a shortage of materials and trades to perform the work, as was seen in the Atlas fire in Napa in 2017 and the Glass fire in Napa/Sonoma in 2020

- Insureds not rebuilding at the loss location due to the loss of an entire city/town as their customers have also moved away due to the destruction of their homes

- Insureds with losses at different locations under their umbrella in both the 2017 and 2020 wildfires

- COVID impact on insured’s businesses which sustained damage in the wildfires

Wildfires in the California wine country bring their own unique circumstances. Having performed calculations for a multitude of wineries over the years, when the assignments started coming in, we had immediate questions such as:

- Where in the crush process was the winery?

- Were the grapes harvested? If so, where were they stored?

- Had the grapes been crushed and not yet yeasted?

- Did the fire destroy the vines?

- Was there damage to the wine?

- If so, in what stage of fermentation was the wine when the fire hit?

- Was there damage to the storage vessel?

- When was it to be bottled and/or sold?

The answers to these questions have an impact on coverage and valuation. We worked with wineries that were in the middle of crush season and the smoke had permeated the skins of the grapes and/or had permeated the vessel in which the wine had been stored. This had caused “smoke taint” to the grapes/wine. In some instances, the insured was able to mitigate the loss of revenue by still selling the wines, but the wines had been “degraded.” The insured was not able to sell the wine as intended but was able to sell it as a blend, at a lower price point, or on the bulk market. Other wineries had been able to produce the wine without using grape skins, so the wine was free of smoke taint.

Thankfully at MDD, we have experience working on claims where there are unusual circumstances. We can draw on our personal experience handling claims or reach out to our network of professionals around the globe to draw on the knowledge of others.

If you would like to draw on our knowledge, please click here.

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.

[1] National Significant Wildland Fire Potential Outlook (nifc.gov)

Lisa Morris

Lisa Morris