This past summer’s heatwaves and wildfires served for many as alarming reminders of climate change. Hotter summers, colder winters, and more hurricanes are amongst the symptoms of a changing global climate[1].

These climatic effects will impact different businesses in different ways. For example, insurance companies will face greater liability exposure from more extreme weather events, and entire coastal economies could be wiped out by rising sea levels.[2] Food producers may undergo shifts in their supply chain due to changes in growing seasons and droughts.[3] And of course, climate-related regulation of various industries (e.g. power generation or oil and gas) can have dramatic effects as well.

As professional business valuators, our fundamental approach to valuing companies consists of projecting their future cash flows, and converting (or “discounting) them to account for the risk that those cash flows won’t materialize. Climate change may mean that a business’s future cash flows might look quite different from what it has experienced in the past, and businesses that we might have expected to continue growing may instead suddenly plateau or even begin contracting. In this short article, we provide a brief case study on how climate change might affect the valuation of a business that depends particularly heavily on colder weather.

Vail Resorts

Vail Resorts Inc. (“Vail”) operates some of the most prominent ski and mountain resorts in the world, including Vail and Breckinridge (US), Whistler (Canada), and Perisher (Australia). Vail’s “Mountain and Lodging” segment accounted for 83% of its revenue during the winter season in fiscal 2020. As a ski resort company first and foremost, climate change challenges Vail’s dependency on long winters and snowfall. The impending threats of climate change and shorter ski seasons would seem likely to threaten Vail’s value, which was $13.8B in early October 2021.

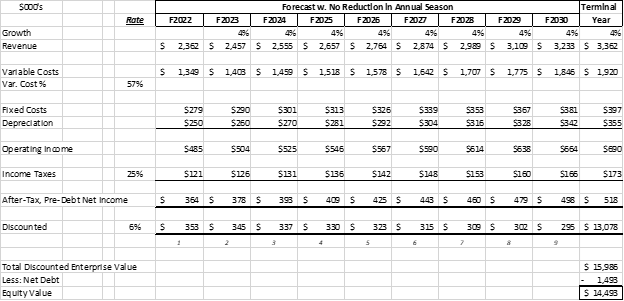

Starting with a base case that assumes there is no climate change (or at least no effects on the business), assuming a weighted average cost of capital of 6% and steady nominal growth of 4%[4] and a variable/fixed cost structure consistent with past results, our base valuation model gives an equity value of $14.5B, slightly higher than Vail’s current market capitalization.

Now, climate change will affect Vail through shortened ski seasons; but how much?

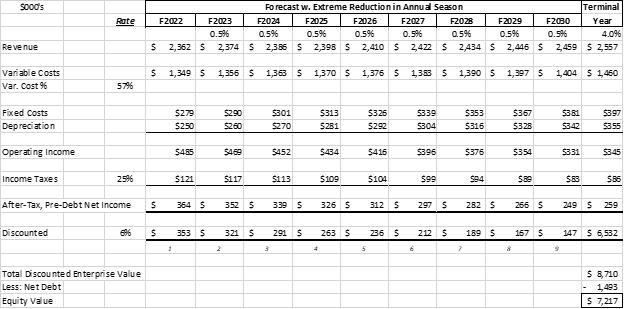

In a normal year, Vail has approximately 4500 “season days” across all their resorts. From historical season length data and Vail’s financial statements, a 1% decrease in season length would likely lead to a 0.76% decrease in annual revenue. From all the news on climate change, one might assume that ski seasons will decrease by, say, 2% per year, and revenue would decrease by 1.5% each year. If we reduce our growth rate for the next eight years to 0.5% (i.e. 2% inflation, less a 1.5% annual decline in ski season), our equity value drops to only $7.2M, or around half of our base case.

The above analysis would suggest that Vail is highly overpriced based on its current market cap. But is it?

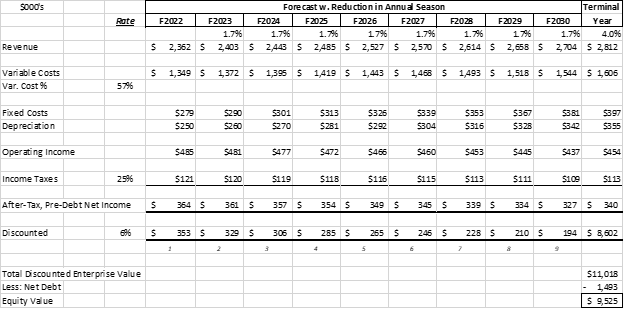

Using data from a Canadian study, “Losing Our Cool: The Future of Snowsports in a Warmer World”[5], it seems likely that Vail’s average ski season length will decrease at a more realistic estimate of 0.4%-0.6% annually, depending on low or high greenhouse gas emission scenarios. This converts to a 0.3%-0.5% decrease in annual revenue, which gives a valuation of approximately $9.5B.

Does that mean that Vail’s stock is still overpriced? Not necessarily. So far, all these cases have assumed Vail won’t change their operation strategies; but what if they adapt? From expanding summer services such as mountain biking and golf to diversify revenue, to leveraging pricing of their multi-resort Epic Pass to create more stable revenue, Vail has tools they can use to reduce their vulnerability to climate change. Markets appear to be betting that they will be at least somewhat successful in that regard.

Conclusion

Vail Resorts and many other businesses will be affected by climate change, but potentially not as catastrophically as it first appears. While prolonged declines in revenue growth can have drastic impacts on valuation, nothing is preordained. Each business will be unique depending on factors such as reliance on the climate, empirical effects of climate, and ability to adapt.

Ephraim Stulberg, CPA, CA, CBV, CFF is a partner in the Toronto office of MDD. He thanks summer student and avid skier, Joshua Der, for his assistance in researching and drafting this article.

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.

- NASA, “The Effects of Climate Change”, https://climate.nasa.gov/effects/.

- Consisting of 2% real growth and 2% inflation