A few weeks ago, Forbes created a social media storm when it proclaimed that Kylie Jenner was poised to become the world’s youngest self-made billionaire. Many thumbs were worn out debating the appropriateness of the term “self-made”, and apparently a GoFundMe page was set up to try to get Kylie over the hump into official billionairedom, although mercifully this was only a gag.

As someone who is only peripherally aware of who Ms.Jenner is, I am perhaps not the best person to comment on all this. But as a business valuator, I do feel I should comment on the basic premise of Forbes’ assessment that Ms. Jenner is worth anything close to $1B. So here it goes.

Inputs for Determining Value

In order to value a company or asset, we need four main inputs:

- Current level of cash flows

- Expected growth rate

- Expected capital reinvestment rate

- Discount rate

According to the Forbes article, the following are basic facts about Ms. Jenner’s business.

- Total sales in 2017 were $330M. Revenue growth that year was only 7%

- Production and fulfillment are outsourced to third parties, and overhead is minimal. Forbes estimates the cost of sales at 55%.

- Her mother takes a 10% cut (of profits? Or sales? The article is unclear) as a management fee.

The Forbes article seems to assume that Kylie’s net profit margins are in the range of 40%. This seems quite high, even given her lack of overhead costs. L’Oreal and Estee Lauder both have pre-tax net operating margins in the range of 15% to 20%. Given that Kylie appears to run a leaner operation, let’s assume a net operating margin of 25%.

Revenue growth last year was 7%, which seems very low for a business that started less than 3 years ago. I’m going to assume that growth will simply equal inflation going forward.

Capital reinvestment seems, in this instance, to be zero, given the image-based nature of the business. You would figure that at a certain point her manufacturer would pass along any such costs to her, but let’s ignore them for now.

For a discount rate, I estimate a rate of 10%, based on an estimated cost of equity consisting of:

- Risk free rate of 2%

- Cost of equity of 5%

- Firm-specific risk 3%

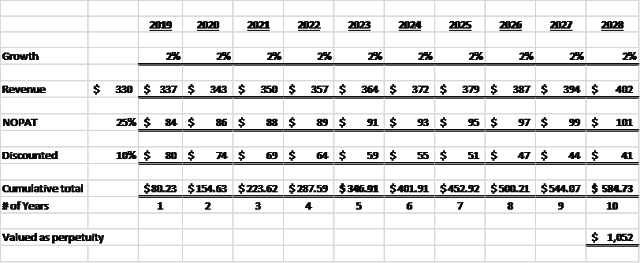

If I apply a basic Gordon growth model, I get ($337M x 25%) / (10%-2%) = $1,052M. So far, Forbes looks to be on solid ground.

The Problems

But there are two problems with this analysis.

First, most businesses are valued based on the assumption that they are going to operate into perpetuity. Thus, L’Oreal has been around since 1909, while Estee Lauder has been in existence since 1946. Of course, when taken literally this is generally not a valid assumption; nothing is “forever”. But it is normally valid to assume that a business will be around for the next 20 years. Any projected cash flows after that timespan have a fairly low present value, so the assumption of a perpetuity makes sense.

Will Ms. Jenner’s personal brand persist for the next 20 years? It is difficult to say, given the vagaries of celebrity culture. To give some context, here are the highest earning celebrities from 1998: http://www.wemakethefunny.com/?p=2116

If we assume that Ms. Jenner’s remaining shelf life is 5 years, the present value of her cash flows falls to $347M; even a 10-year forecast gives a valuation of $585M.

There are obviously a lot of assumptions in the above table, and in many ways that is precisely the point.

The more basic problem with Forbes’ analysis, however, is simply the question of what exactly one would be buying if one purchased Ms. Jenner’s company. It owns no physical assets, it doesn’t really have much of a labour force, and it does not seem to own much IP. Its ability to generate cash flows is tied solely to Ms. Jenner’s personal fan base. In theory, Ms. Jenner could sign some sort of contract to guarantee continual promotion of the company, which might tie her compensation to the continued success of her brands. But that is a far cry from being able to liquidate her company, right now, for $1B.

By Ephraim Stulberg.

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.