COVID-19’s Impact On Business Valuation

08 June, 2020

-

Jarrett Reaume

-

Canada

This is the second blog post co-authored by MDW Law Partner, Christine Doucet, and MDD Forensic Accountants Partner, Jarrett Reaume, addressing various aspects of COVID-19’s impact on business owners and family law issues. Their first blog post was “Guideline Income for Business Owners in the Wake of COVID-19”

The COVID-19 pandemic has negatively affected many businesses. Restaurants, personal and wellness establishments and daycares (and other businesses) are just starting to reopen after almost three months of closure. For many other businesses that have remained opened, sales are way down. With many predicting that a vaccine will not be readily available for 12 to 18 months, the pandemic’s impact on business profits may last beyond a few months, possibly even years.

In addition to its serious effect on the cashflow of Nova Scotia businesses, the pandemic will also affect the value of many businesses, as well as impacting the viability of a sale in these uncertain times. Changes in businesses valuation may impact the resolution of divorce cases involving business assets.

This is already an area of complexity in Nova Scotia law. In Nova Scotia, a true “business asset” is not considered matrimonial property. There are many circumstances that can result in a business being determined to be a matrimonial asset (such as a contribution by the non-owning spouse or an injection of family money into the business). However, these are not simple determinations and require an analysis of the historic creation and operation of the business. Even if a business is a true “business asset” and not matrimonial property, the non-owning spouse may seek an unequal share of the matrimonial property. Valuations are therefore often carried out in divorce matters by one or both parties.

Business Valuations

The value of a business (i.e. Enterprise Value, or “EV”) is generally equal to the present value of its future after-tax cash flows. Changes in value will be influenced by two main factors:

- The amount of yearly after-tax cash flows; and,

- The riskiness of those cash flows.

The level of risk is generally dealt with in selecting an appropriate capitalization rate to present value the future cash flows, which in the case of a stable, mature business are assumed to be constant into the future. Holding all else constant, the capitalization rate and valuation conclusion move in opposite directions – the higher the capitalization rate the lower the resulting value and vice versa.

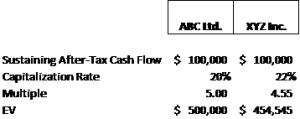

To illustrate, let’s consider two businesses: ABC Ltd. and XYZ Inc. Both businesses operate automotive repair centers in Halifax, and as of December 31, 2019 both could be reasonably estimated to have sustaining annual after-tax cash flows of $100,000. Whereas ABC services a wide variety of customers, XYZ earns most of its revenues from a few fleets. Because of its customer concentration, XYZ’s cash flows are considered riskier than ABC’s. As a result, let’s assume that appropriate capitalization rates are 20% for ABC and 22% for XYZ. For the non-valuator, a capitalization rate is the inverse of a multiple. So, a capitalization rate of 20% is the same as a multiple of 5x[1]. Below are the resulting EVs for ABC and XYZ:

This illustration demonstrates that two businesses operating in the same industry with the same amount of annual after-tax cash flows may not be worth the same amount.

Fast forward a few months to March 2020. Let’s now assume that ABC’s after-tax cash flows for the next three years are now expected to be negative $50,000 in year one, break-even in year two, then recover back to $100,000 in year three and onwards. Further, imagine that, due to the uncertainty associated with the road to economic recovery and the risk of a second wave (and perhaps even a third wave), an appropriate discount rate is now 23%. The following demonstrates ABC’s revised EV based on these assumptions:

The above illustration demonstrates that ABC’s value has been cut in half in the space of a few months. Even though ABC’s cash flows are expected to return to normal in three years’ time, a few rocky years combined with more uncertainty results in a much lower valuation conclusion.

Effect on Nova Scotia Divorce Cases

What does this mean for separated spouses in Nova Scotia? It will add a layer of uncertainty to the already complex question of the proper valuation date for a business.

In some cases, the date of separation is determined to be the relevant date for valuation; in others the valuation date will be closer to the date of resolution (i.e. settlement or trial). When the value of a business changes dramatically after the date of separation, parties may need to make a case for an entirely different valuation date that takes into account the new circumstances. It is easy to foresee that this argument will arise regularly in the coming months. Furthermore, when the pandemic hit this province in mid-March, many parties were already before the Nova Scotia courts. In some of those cases, parties had submitted expert reports providing valuations of businesses, which by their nature provide evidence of value as of a specific point in time (such as the date of separation or the latest fiscal year-end).

Because a business is valued at a point in time without the benefit of hindsight, it is expected that a hot topic for a while will be determining when the financial impact of the pandemic was reasonably foreseeable.

As the value of a public company’s stock is generally accepted to be the present value of future cash flows associated with holding that stock (i.e. dividend payments), an objective assessment in terms of determining when the financial impact of the pandemic was reasonably foreseeable may be the S&P TSX Composite Index. This index tracks around 250 companies and represents approximately 70% of the total value of equities traded on the TSX. Below is a graphical depiction of the TSX’s performance over the past 6 months:

The TSX reached its peak at February 20, 2020, at which time China had around 75,000 documented COVID-19 cases and Canada had around 10. Fast forward a few weeks and the TSX dropped around 1,200 points or approximately 7%. Subsequently, the TSX experienced a significant decline in the latter part of the week of March 2, 2020, followed by a further decline which eventually bottomed out on March 23, 2020.

Thus, a reasonable argument may be that the full extent of the financial impact of the pandemic, insofar as it pertains to Canadian firms, was reasonably foreseeable during the first few weeks of March 2020, but not necessarily before. Accordingly, it may be reasonable to assume that a valuation report for a business using a valuation date prior to March 2020 would not include any negative impact associated with the pandemic. Therefore, two weeks can make a material difference in terms of selecting alternate valuation dates.

Conclusion

It is recommended that impacted parties seek legal advice and consult with a Chartered Business Valuator regarding the selection of a valuation date and the corresponding financial impact on value. The COVID-19 pandemic will continue to have far-reaching effects in family law in Nova Scotia in the months to come.

By Jarrett Reaume and Christine Doucet, Partner at MDW Law.

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.

1 / 20% = 5.

Authors

Jarrett Reaume

B.Acc, CPA, CA•IFA, CBV, CFF, Partner/Senior Vice President

- +1 902.868.2789

- jreaume@mdd.com

- Halifax, NS, Canada

Articles

Relevant Articles

Our experts are extremely knowledgeable about thier subject areas and often write educational material and commentary on topical issues they come across.

Measuring Business Interruption Claims: A Case Study From Christchurch and Kaikoura Earthquakes

Earthquakes are a historically prominent event in New Zealand, occurring most commonly in the Southern and Eastern areas of the North Island and most of the South Island. This is because New Zealand falls over the Australian and Pacific tectonic...

Understanding Business Interruption Following a Cyber Attack

Why Idle Labour Costs Are Typically Not an Indemnifiable Loss We have all experienced periods when suddenly our emails or internet go down. In instances such as these, short as they may be, it is only natural to feel lost...

Floods in the South of Germany in June 2024: Highly Complex Business Interruption Losses

At the beginning of June 2024, unusually high precipitation occurred in large parts of southern Germany. This resulted in flooding and in property damage to residential and commercial properties over a large area. Initial estimates provided by the German insurance...

High Grade Ore And A Question Of Indemnity

When a mine suffers business interruption, the issue of high grading can come into play. The question is whether insurers should actually benefit? Mining business interruption insurance and the principle of indemnity is no simple matter. Take the case of...

Renewable Energy Losses – Winds of Change

It is May 20, 1899. New York City taxicab driver Jacob German is the recipient of the United States’ first-ever speeding ticket. He whizzed by at 12 miles per hour on Lexington Avenue and was then pursued and remanded by...

Business Interruption Considerations for Hotel Losses

Irrespective of the industry in which an Insured operates, the basic intent of business interruption (“BI”) coverage is to place the Insured back into the same position they would have been in had the insured peril not occurred. Those of...

Property Damage and Derechos

On 29th June 2023, a rare type of storm called a "derecho" swept across the Midwest region of the United States, mostly impacting the states of Missouri, Illinois and Iowa. The derecho began as a rotating supercell thunderstorm that spawned...

Variable Mining Costs – How Should They Be Treated?

Variable expenses: one would consider this to be one of the easier aspects in the analysis of a mining claim; however, that is far from the truth. When it comes to mining losses, the determination of which costs are considered...

The Effect of Volatility on Power Generation Business Interruption Losses

It is clear to the casual observer that many aspects of the economy are facing volatility. Fuel, energy, labor, shipping - all have experienced unprecedented shortages and price increases because of a myriad of conditions. The Russia-Ukraine war, Covid-19, inflation,...

Waste to Energy

What is Waste to Energy? Waste to energy refers to the process of converting municipal solid waste (MSW), otherwise known as trash, into usable heat, electricity, or fuel. The three main MSW categories include: Biomass or biogenic (plant or animal...

Ghosts, Ghouls and Cyber Claims

We usually think of Hallowe’en when October rolls around; however, did you know that October is also cyber security awareness month? NetDiligence recently released the 12th iteration of their Cyber Claims Study. They analyzed approximately 7,500 cyber claims from period...

An Introduction to Natural Gas: Separation, LNG and GTL Plants

Our first technical briefing introduced the Oil & Gas value chain, divided into: i) upstream; ii) midstream; and iii) downstream. Here is a recap, before we explore natural gas in more detail. Upstream: this involves the exploration and extraction of...

The Broader Impact of CAT Events

While every catastrophe (“CAT event”) leaves a wake of destruction in its path, there are times when the financial impact is more widespread than the physical damage would indicate. Consider the following examples: Pandemic – 2020 The impact of COVID-19...

Mining BI Insurance: Remediation and Rehabilitation

All mines, no matter how vast or intricate, are ultimately temporary and will one day be depleted. When all valuable materials are extracted, or at least those that are cost-effective, mining operations will cease, and the mine will be decommissioned....

Calculating the Effects of a Natural Disaster

The Allianz Risk Barometer 2022 reported that natural catastrophes are now the third-highest global business risk, while climate change has moved into the sixth position. These rankings represent 25% and 17% increases from last year.[i] Furthermore, the increasing complexity of...

ESG Disputes and Business Valuation

Environmental, Social and Governance (“ESG”) factors have gained increasing importance in recent years as society has become more aware of how corporate conduct affects stakeholders, the environment and humanity at large. From issues such as climate change to socially responsible...

Renewable Energy Certificates

Since 1978, American regulators and policymakers have looked to incentivize the investment and development of generating renewable energy. Individual states began enacting Renewable Portfolio Standards (RPS) to support this mission by requiring a specific percentage of a utility’s energy portfolio...

Mining BI Insurance: Depreciation, Depletion and Amortization

The use of depreciation, depletion and amortization (DD&A) is an accounting method that allows the cost of an asset to be recorded as an expense over a period of time in order to reflect the use and consumption of the...

Role of a Forensic Accountant in Divorce

During the course of matrimonial disputes, there are often situations where solicitors and their clients find it helpful to engage specialist consultants. Forensic accountants can assist at various stages of divorce proceedings, in order to provide a clearer picture of...

Potential Quantification Issues for Losses Involving Wind Farms Under Construction

Quantifying the financial impact stemming from the failure of an already commissioned single stand-alone wind turbine generator presents challenges, but these challenges increase exponentially when the failure occurs at a wind farm under construction. Additional complexities surface to the extent...

Measuring Refining Margins for a BI Loss

When it comes to Business Interruption policies for Oil & Gas risks, there are different types of coverage available in the market, including Gross Profit, Gross Earnings, Specified Standing Charges etc. Common Policy Wordings Gross Profit equates to Turnover less...

The Importance of Mining Plans

Any well-run business starts with a plan, and a mining operation is no exception. Plans and budgeting or forecasting allow management to prepare for a future period, whether in the short-term or in the long run. Based on projections, management...

Business Valuation, Growth Rates and Climate Change: a Case Study of Vail Resorts

This past summer’s heatwaves and wildfires served for many as alarming reminders of climate change. Hotter summers, colder winters, and more hurricanes are amongst the symptoms of a changing global climate[1]. These climatic effects will impact different businesses in different...

Mining BI Insurance and the Impact of Changes in Ore Grade

Ore grade refers to the metal content of an ore deposit, and it is the value of the contained metals or minerals less the cost of extracting and refining that drives the economics of a mine site. There can be...

Lost Profits Measurement in the Cannabis Industry

What used to be considered an illicit drug in most countries is now a decriminalized plant with some medicinal potential. Cannabis is in the midst of a global transformation into a major industry with massive investment and growth potential. Canada...

The Varying Effects of a La Niña Cycle on Business Interruption Claims

Earlier this month, Australia’s Bureau of Meteorology announced that the current La Niña conditions would likely continue over the coming months.[i] According to the National Oceanic and Atmospheric Administration, the La Niña effect occurs when there are “periods of below-average...

Business Interruption Measurement Considerations in a COVID-19 World

Although hurricane season doesn’t normally conclude until November 30th, we have already exhausted the modern English alphabet in terms of named hurricanes. In the last year, we’ve also seen an ever increasing number of wildfires, explosions and tropical storms. While...

The Triple Threat: Pandemic, Natural Catastrophe and Business Interruption

Calculating business interruption losses following a natural catastrophe (“CAT”) has always been as much of an art as a science, requiring forensic accountants to use their education, experience and training to resolve the complexities inherently present in quantifying business interruption...

Best Practice in Claims Management: Large and Complex Business Interruption Losses

Business Interruption (“BI”) has hit the headlines in the Middle East possibly more than ever this year, with disputed claims over COVID-19 closures, cyber incidents and anticipated losses following the recent Beirut explosion. This is in addition to BI claims...

Claim Considerations Related to the Beirut Port Explosion – Part 2

On 17 October 2019 large numbers of protesters began appearing in Martyrs Square, Nejmeh Square, and Hamra Street, as well as many other areas of Beirut and throughout Lebanon. The reasons for the protests are wide reaching from a social,...

Claim Considerations Related to the Beirut Port Explosion – Part 1

In this two-part series, we write about the claim considerations related to the Beirut port explosion on 4 August 2020. On 4 August 2020 at approximately 18:00 local time, an explosion measuring 3.3 on the Richter scale ripped through Beirut...

Is the Perfect Storm Brewing?

Insurers around the globe currently have their attention firmly fixed on addressing the enormity of client claims relating to COVID-19 but is there another dark cloud gathering on the horizon? Recent scientific information includes NOAA issuing their forecast on May...

COVID-19’s Impact On Business Valuation

This is the second blog post co-authored by MDW Law Partner, Christine Doucet, and MDD Forensic Accountants Partner, Jarrett Reaume, addressing various aspects of COVID-19’s impact on business owners and family law issues. Their first blog post was “Guideline Income...

Guideline Income for Business Owners in the Wake of COVID-19

Business owners don’t need an economist to tell them how dramatically their profits have been affected by the COVID-19 pandemic. For those owners who are separated from their spouse, these poor results are impacting how much “available income” they have...

Is Kylie Jenner a Billionaire, or Even Close? Part III

I hope this will be the final installment in this series, but one never knows. Back in the summer of 2018, I wrote a short piece questioning a sensational Forbes magazine article claiming that Kylie Jenner was worth $1B, based mainly...

COVID-19: A Forensic Accountant’s Perspective on How Coverage Issues Could Impact Quantification

The current outbreak of coronavirus disease (COVID-19) was first reported from Wuhan, China, on 31 December 2019. According to the World Health Organization (“WHO”), by 26 February, China had reported over 78,000 cases of COVID-19 resulting in over 2,700 deaths....

Is Kylie Jenner a Billionaire, or Even Close? Part II

A little over a year ago, I wrote a short blog post taking issue with a Forbes magazine article that had concluded that Kylie Jenner's net worth was around $900 million. In light of last week’s news that Coty Inc., a publicly traded cosmetics firm, is...

Accounting for Business Interruption Loss after Cyber Attack

Cyber attacks are happening with an alarming frequency, impacting mostly small to medium-sized businesses. According to Statistics Canada, in 2017 more than 20 per cent of Canadian businesses reported they were impacted by a cyber security incident. As fears of...

Business Interruption Losses Involving Dairy Farms

As anyone who followed the debate over the USMCA trade agreement last fall will know, Canada’s dairy industry is a regulated one. As a result, business interruption calculations involving dairy farms will often contain a number of moving parts that...

Cyber Losses & Business Interruption

Malware. Ransomware. Phishing. Wannacry. Petya. NotPetya. The terminology of cyber attacks and cyber losses seems to change at a bewildering pace. As technology continues to advance and businesses become more reliant on their IT systems, cyber attacks will become more...

How to Calculate Losses Under Business Interruption Coverage

In this article we provide a brief overview of how to calculate losses under business interruption coverage. Broadly speaking, business interruption (“BI”) insurance coverage is meant to indemnify the insured for the loss of profit it suffers as a result...

Non-Damage Business Interruption

This month our technical briefing introduces the broad topic of non-damage Business Interruption (BI), including a discussion on: The typical boundaries of traditional property damage business interruption insurance. What we mean by the term 'non-damage BI' and types of events...

Evolution of Business Interruption Insurance in the Global Market Place

From its origin back in the 18th century, the appetite for a form of insurance to cover losses of a business due to an interruption has continued to mature and grow. Whether the risk be fire, explosion, hurricane, cyber-attack, or...

Regulated and Deregulated Electricity Markets: What is the difference when modelling power generation losses?

Introduction When modelling power generation losses for Business Interruption (“BI”) or Delay in Start-Up (“DSU”) purposes, it is important to understand the type of market(s) the Insured participates in and specifically how it operates within those markets. In this introductory...

Buying Shares in an NFL Player? Business Valuation Principles Still Apply

In my last post, I argued that an investor in Kylie Jenner’s cosmetics company was essentially investing in Ms. Jenner’s personal brand, and that the earnings stream for that brand was of a finite life. The post got me thinking:...

Forensic Accounting Liability Exposures

The below article first appeared in THE STANDARD, New England’s Insurance Magazine. It features excerpts from a presentation given by MDD partners Paul McGowan, CPA, CVA and Jon Ducey, CPA, CVA on the topic of liability claims and other key...

The Unique Perspective of a Certified ‘Forensic CPA’ Arbitrator

Alternate dispute resolution (ADR) is any procedure that is used in matters that would otherwise be settled in a court of law. Examples of ADR include arbitration, mediation, appraisal, and mini-trial. ADR is a dispute resolution strategy with applications to...

Is Kylie Jenner Really a Billionaire, Or Even Close?

A few weeks ago, Forbes created a social media storm when it proclaimed that Kylie Jenner was poised to become the world’s youngest self-made billionaire. Many thumbs were worn out debating the appropriateness of the term “self-made”, and apparently a GoFundMe page...

Caribbean ‘vacation’ for CAT claims

As a global forensic accounting firm, we at MDD have a “boots on the ground” mentality when it comes to quantifying economic damages for catastrophe (“CAT”) claims. The busy hurricane season in 2017 meant that I, along with many of...

Valuing a Franchise System

Valuing a franchise system, or “franchisor”, is in many ways very similar to the valuation of any other type of business; it is a function of the forecasted levels of cash flows that the business will generate, and the risk...

How Much Is Your Business Worth?

As a Chartered Business Valuator (CBV), almost every business owner I meet wants to know the answer to this question: “How much is my business worth?” There can be many reasons for asking this question: they may be planning to...

Mining Claim – All Is Not As It Appears

In this briefing we focus on mining claims, and share our knowledge and technical expertise on one of the loss measurement issues regularly encountered in mining claims, production bottlenecks. What you will learn from reading the article include: How the...

What Type of Business Valuation Do I Need?

In my previous article, I discussed the critical need for business owners to have their business valued by a professional appraiser. In this article I will discuss the two types of business appraisals that you might want to consider. Calculation...

Should I Have My Business Valued?

What's so important about having a valuation of my company? Small business owners spend most of their time IN THEIR business and not ON THEIR business. Further, they view expending money on getting a professional valuation performed as a completely...

Mexican Standoff – Insured Losses in Mexico Following Recent Catastrophes

September 2017 was a brutal month for the people of Mexico, with two earthquakes and a hurricane causing untold misery, multiple deaths and substantial property damage across the country. But if the general view in the global reinsurance market is...

Business Interruption Insurance and Dealing with Natural Catastrophe Events

Late 2017 has witnessed a flurry of catastrophic weather events that has led to widespread devastation. Hurricane Harvey set the ball rolling, with unprecedented rainfall in the southern United States. Irma then destroyed several Caribbean islands, rendering many uninhabitable, before...

Identifying and Measuring Short Duration Business Interruption Losses

What have we really lost? One of the most common issues that arise from short-duration interruptions, those measured in days as opposed to weeks or months, is whether the business actually suffered a permanent loss of revenue or whether the...

Mining Business Interruption Insurance and the Principle of Indemnity

Mining Business Interruption Insurance and the Principle of Indemnity A contradiction? How can a mine claim for lost production when the ore is not lost and will be mined? Why does a mining company need to purchase business interruption insurance...

Cyclone Debbie May Create Complex Claims Issues for Insurers

Cyclone Debbie and the subsequent rain and flooding events across Queensland, Northern NSW and New Zealand have caused significant damage to property and infrastructure, limited rail access, closed ports and caused damage to numerous roads and bridges. Rail closures in...

Financial Impact of New Zealand Kaikoura Earthquakes Felt Beyond Earthquake Zone

While the damage to physical property as a result of the Kaikoura earthquakes in November 2016 has been well documented, the financial impact of these events are ongoing both on businesses physically affected by the earthquakes as well as businesses...

How Is Big Data is Changing the Insurance Industry?

We live in a world of Big Data. Petabytes, Zettabytes, Yottabytes of data. The Internet of Things (IoT) increasingly connects day-to-day appliances, machines and equipment with each other. Billions of devices constantly recording data: sensors, cameras, microphones, thermostats, pressure gauges,...

Contaminated Products Insurance Claims: How to Check the Costs of a Product Recall

The number of food product recalls reported in the UK through the FSA (Food Standards Agency) rose 78% in 2015. With many UK businesses operating internationally, a product recall situation can impact many countries and cost millions of pounds in...

Staying Afloat in the Flood – The Cost of Flooding to Companies with Exposures in India

Given the number of major flood occurrences in India in the past decade, European and US companies with exposures in the country should examine their insurance coverage and disaster management planning. As the waters start to subside following India’s latest...

The Effect of Deductibles & Policy Wording – Is It What You Think?

With a typical Energy claim standing at approximately USD 4.5 million, it’s no surprise that Business Interruption (BI) is once again the #1 business risk for the fourth year in a row[i]. To help insurers mitigate their exposure when an...

Business Interruption: Complex Interdependencies

As business structures become more complex, companies often need more sophisticated insurance products to properly manage their business interruption risks. For example, narrow vertical integration makes risk management more difficult and increases the demands placed on insurers regarding correct risk...

Stemming the Spiralling Cost of Delay: Delay in Start Up (DSU) or Advance Loss of Profit (ALOP) Insurance Cover

Delay in Start Up (DSU) or Advance Loss of Profit (ALOP) insurance cover is an absolute necessity for large and/or complex construction or engineering projects, particularly those financed with structured debt. This insurance was designed to provide cover for the...

Canadian Wildfire Present Challenges to Business Owners and Their Insurers

The Canadian wildfire which started in early May 2016 southwest of Fort McMurray affected a population of about 90,000 and led to destruction of over 2,400 structures. The sheer ferocity and speed of the fire took both public services and...

Catastrophe Events and Business Interruption Insurance

In the event of a devastating catastrophe (“cat”) be it an earthquake, hurricane, flood, or tornado, the first and foremost priority is to ensure the safety all the people involved. Once this has been established, business owners can then begin...

Business Valuations & Why It Pays To Use Genuine Experts

The Basics Assets have value if they will give rise to future economic benefits. For businesses, these future economic benefits take the form of either the expected net income stream or the amount that could be realised in the short...

Gift Cards and the Illiquidity Discount – A Valuation Perspective

With the busiest season of the year for retail sales upon us, you are no doubt wondering what to buy for that special someone. If you’re reading this blog – and I have every reason to believe you are –...

I Lost My Customers and It’s Your Fault!

In Schwartz Levitsky Feldman LLP v. Werbin, 2015, an action was put forward by Schwartz Levitsky Feldman (SLF) claiming loss of profits due to the departure of Mr. Werbin. The firm contended that they purchased Werbin’s clients when they purchased...

The Dividend Double Count

In this post, I touch on a common error I encounter in dealing with a financial analysis of multiple companies owned by the same group or individual. I call this error the “dividend double count”, for reasons that will become...

Adding up the Damage: Lost Profits vs. Business Value

When a business is destroyed as a result of wrongdoing, there are two commonly used methods by which the plaintiff’s damages may be measured. One method is to appraise the value of the plaintiff’s business at the date of loss;...

Calculated Risk: A $75M Award Adds Urgency to Pre-Judgment Interest Considerations

Pre-judgment interest is often the last thing litigants ponder. A recent award of $75 million in pre-judgment interest in Eli Lilly v. Apotex, 2014 FC 1254 (“Cefaclor”) may change that. Cefaclor involved the infringement of patents for an antibiotic. Damages...

Personal Injury Losses and the Self-employed: A Business Valuation Perspective on Labour & Capital

Business valuation concepts can be critical for the proper quantification of personal injury damages, particularly in the context of self-employed individuals. Business valuators are commonly called upon to assess the fair market value of small, owner-managed businesses. One of the...

5 Ways You Should Be Using Your Financial Expert

Moore v. Getahun 2015 ONCA 55 is a case that has already generated a lot of discussion and navel gazing in both the legal and expert communities, and I hesitated for quite a while before deciding that I had anything worthwhile to...

Pre-Judgment Interest, Part III: Property Damage, Profit, and PJI

My practice involves a lot of work for property insurance companies. When damage to property occurs, the property owner may advance a claim against the third party tortfeasor for both the value of the damaged property as well as an...

Pre-Judgment Interest, Part II – Interest and Taxes

In the previous post, I discussed the large pre-judgment interest award in Cefaclor. In that case, one of the issues raised by defendant’s counsel was that to award the plaintiff compound interest would result in overpayment; since the damages award is...

Inflation and Family Law

I was looking through my oldest daughter’s baby book last night and found that we had noted the price of gas at $0.70 per litre; I had noted at the time that this was “really high”! This got me thinking...

Dunkin’ Donuts c. Bertico inc., Part II: Lost Profit & Loss of Business Value

Towards the end of its decision in Dunkin’ Brands Canada Ltd. c. Bertico inc.2015 QCCA 624, the Quebec Court of Appeal discussed the issue of whether an award for both a) lost profits up to 2005 and b) loss of business...

Untying the Knot: A Forensic Accountant’s View of Divorce Proceedings

During the course of matrimonial disputes, there are often situations where solicitors find it helpful to engage specialist investigators and appraisers. In particular, forensic accountants can help to provide the court with a clearer view of the true financial position...

Cyber Loss – The Cyber Threat Facing Businesses

Businesses face the risk of financial loss and disruption due to theft of private or sensitive information, attacks on IT systems, and fraud. MDD's Norman Kwan shares that cyber risks policies are still evolving and there are issues that need considerations...

Agricultural Loss – Quantifying Economic Damage for a Hog Farm

Damage quantification for livestock losses can be difficult as it often requires consideration of market price fluctuations, age and weight of livestock at the time of loss and the end purpose of the livestock - considering whether they are for...

Business Interruption Loss – The Interaction between Inventory Losses and Business Interruption Claims

This article explores the areas of overlap between insurance coverage for inventory loss and business interruption. In the event of physical damage to inventory, different policies provide different valuations, including: replacement cost, actual cash value, historical cost or selling price. ...

What to do When You Can’t Get to Documents

On June 20, 2013 Southern Alberta endured a catastrophic flood resulting in a significant amount of property damage, numerous civil authority evacuations and power outages for individuals and businesses. In any major catastrophe, access to supporting documentation may not be...

Accounting For Attorneys

It is becoming increasingly important for attorneys to understand financial statements and their relevance to various types of business and legal situations. The non-accountant attorney will greatly benefit from a basic understanding of the key principles of accounting. Equally important...

Quantifying Business Loss Involving Expropriation of Newly Established Businesses

With increasing activity in public works projects in the Greater Toronto Area (e.g. the Toronto-York Spadina Subway extension) and other highway expansions across Ontario, we can expect a large number of businesses to be affected by expropriation. This article will...

Business Interruption Claims and the Start-up Enterprise

Measurement of business interruption losses, under normal circumstances, is mathematics combined with fact gathering to establish proper assumptions in measuring the loss. Historical records can be analyzed to determine the experience of the business had the insured loss not occurred. ...

The Global Economy’s Impact on Business Interruption & Extra Expense Claims

While the signs have been around for some time now, the economic crisis that seemed to officially begin with the failure of the U.S. mortgage institutions Fannie Mae and Freddie Mac has now morphed into an unpleasant reality that is...

Coinsurance: Can Someone Please Explain This to me Once And For All?

In the US property insurance market, coinsurance, an often-misunderstood concept, refers to the sharing of risk between the insured and the insurer and applies to property damage and business income loss coverage. Coinsurance as it applies to Property Insurance Because...

Fight the Battle on Two Fronts – Liability and Damages

Plaintiff and Defense attorneys are guilty! Guilty of waiting until the last minute to address areas of damages. MDD is very often retained in litigation engagements when the measurement of damages takes a back seat to liability and causation. Although...

The Forensic Accountant’s Role in a Large Loss

No matter how well a risk management team has planned for it, actually dealing with a catastrophe can be a distracting and stressful financial challenge. The adjuster's ability to manage his resources and work through the complex claim issues that...

Handling Large Complex Claims

Large insurance claims are almost always complex, time-consuming and in need of a forensic accountant. They are complex because of the secondary impact from the misfortune setting off the initial claim. Take, for example, a fire at a ski hill...

The Role of a Forensic Accountant as an Expert Consultant and an Expert Witness

For many years, attorneys on both sides of the courtroom have turned to forensic experts to support their position as well as to identify the potential strengths and weaknesses in the arguments of opposing counsel. Additionally, attorneys can use expert...

Projecting Sales in Business Income Losses is an Art – Not Necessarily a Science

Insurance policies generally state that in determining the Actual Loss Sustained under business income coverage, consideration must be given to actual experience of the business before and the probable experience thereafter had no loss occurred. Thus, the goal in evaluating...

The Impact of Foreign Exchange Rate Movements on Loss of Profit Claims

Foreign exchange risk has been high on the agenda of CFOs of MNCs for many years. With the expansion of the global economy and diverse influences on exchange rates - such as the current climate of economic uncertainty and fear...

Business Valuations: When You Would Need One

Business valuations in one form or another have been around for decades. As a result of the Eighteenth Amendment to the United States Constitution, the Internal Revenue Service began issuing memorandums and directives relating to methods for determining values and...