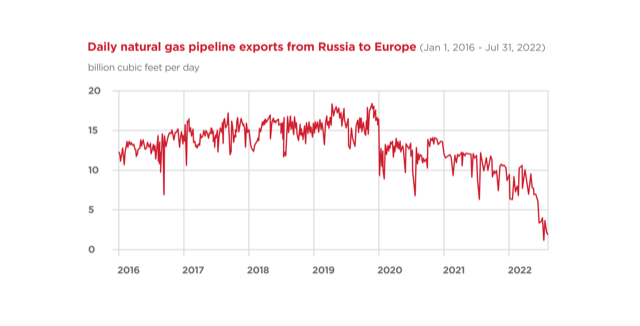

The sanctions imposed on Russia amid the Russia-Ukraine conflict have impacted global gas markets, particularly those in Europe. Russia is the second largest producer of natural gas globally and used to supply about 40% of Europe’s natural gas. However, supplies from Russia to Europe are currently below 10% following the complete shutdown of gas flows through the key Nord Stream 1 pipeline since late August 2022, citing technical problems caused by sanctions. The restart of Nord Stream 1 pipeline appears to have been indefinitely delayed after a number of sudden and unexplained gas leaks were detected in the Nord Stream 1 and its idle parallel pipeline, Nord Stream 2, during the last week of September 2022.

Conversely, Russian gas has been diverted from Europe to China and India (to a lesser extent), to meet their growing energy demands. Russia’s gas sales to China via a Siberia pipeline grew by about 60% year-on-year in the first eight months, compared with 2021. Russia is also planning to deliver additional pipeline gas to China via Mongolia and the Far Eastern route. In addition, China has secured Russian LNG at nearly half the current spot price through the end of this year, thereby resulting in Russian LNG deliveries to China surging to the highest since 2020. China’s economic slowdown, resulting from widespread covid shutdowns, has left it with a surplus of natural gas that it is re-selling to Europe at inflated prices. China used to be one of the largest LNG importers, but it is now exporting some of its surplus and has effectively become a middleman between Russia and Europe. However, as soon as economic activity revives in China, it is likely that the situation will reverse and the shipment of Chinese LNG to Europe will decrease.

To reduce the dependency on Russian gas and find sustainable alternatives to Russian gas, the EU has rolled out several strategies in the past few months, which focus on diversifying supplies (from securing non-Russian suppliers of gas and increasing the import of LNG), reducing demand (from energy savings initiatives) and ramping up the generation of green/renewable energy, as discussed below.

- Increase in non-Russian pipeline imports: the effort to diversify gas supplies includes opening up the Southern Gas Corridor with Azerbaijan and developing the Mediterranean hub with North African and Eastern Mediterranean partners. However, this may not be a viable near-term option as most gas suppliers are producing at close to maximum levels with no immediate spare production capacity.

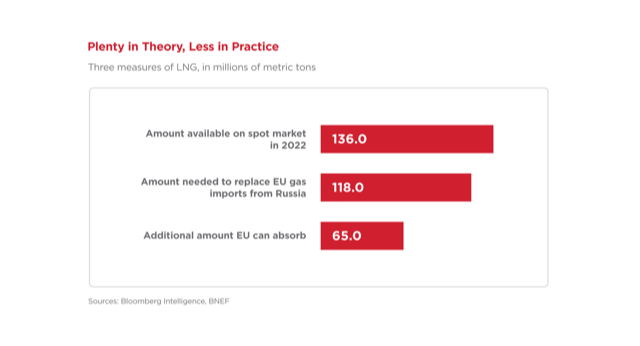

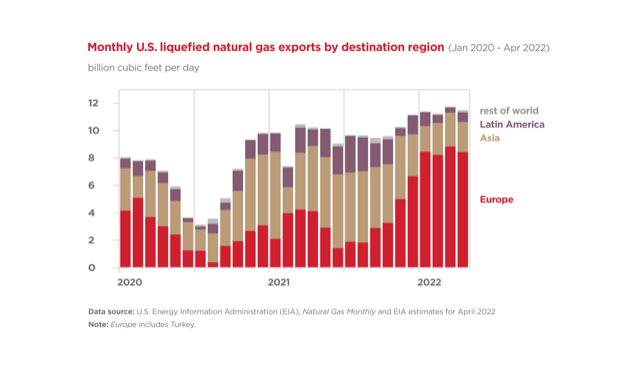

- Increase in Liquefied natural gas (LNG) imports: LNG is simply natural gas in liquid form for ease of transportation or storage. There has been a significant acceleration towards investment in new LNG import capabilities, with an increase in LNG imports from the United States. Roughly 30% of global LNG exports are sold on the global spot market, which is theoretically sufficient to cover the gas import from Russia. However, the LNG import terminals only have capacity to accept around half of that, mainly driven by a limited amount of regasification capacity. The EU is prioritising the upgrade and extension of LNG infrastructure and demand for Floating Storage and Regasification Units (FSRU), which are more cost-effective and faster to build than onshore terminals, has grown rapidly, with at least 25 FSRUs leased since the Russia-Ukraine conflict. The situation has been further exacerbated by the outage at the Freeport LNG export terminal in early June 2022, which supplies about 20% of United States’ total LNG exports, with full operation not expected to resume until March 2023. The tightened supply has sent LNG prices soaring in both European and Asian markets (although conversely gas prices in the US have fallen as a result).

- Increase in renewable power generation: there has been a strong push for renewable energy transition, by making additional investments and accelerating the rollout of renewables, particularly solar and wind energy. European countries are in the process of designating ‘go-to areas’ of land or sea where renewable energy would have a lower environmental impact, allowing fast-track permitting of wind and solar projects. However, Covid-related lockdown measures and social-distancing guidelines have created significant hurdles within the supply chain, including the shortage of critical materials required in the production of renewable energy infrastructure and the limitation of cargo ships and containers.

- Acceleration of replacement of gas boilers with heat pumps: heat pumps are far more cost-effective and efficient than traditional gas boilers. European countries aim to expedite the adoption of heat pumps for household and industry usage to reduce overall gas consumption. However, the barriers to heat pump deployment include high upfront costs for installation and sometimes building transformation, as well as larger space requirements.

- Acceleration of energy efficiency programs: European governments are urging households and businesses to consume energy more efficiently. Turning off lights/radiators in unused rooms, limiting the use of air conditioning in public places, and lowering thermostats are among the ways of energy savings practices. In order to achieve further reduction in energy consumption, there has been a strong focus on new technologies such as insulation, double glazing and home improvements.

There are no quick solutions for Europe and the success will largely depend on how early, sustained and coordinated the actions are across Europe, especially as winter approaches. UK is considering long-term gas deals with Norway and Qatar that would commit the UK to buy agreed annual quantities of gas at an agreed price. However, the main concern is this might lock in long-term higher prices if gas prices fall in the future.

A crucial part of the EU’s plan to reduce dependence of Russian gas imports is to significantly increase its LNG purchase. However, there is only so much LNG for spot sale on the global market and the battle between Asia and Europe to secure gas supplies is intensifying. European gas prices are trading at a premium to Asia and more LNG is being pulled into Europe. The United States, who has become the world’s largest LNG exporter, delivered nearly three quarters of its LNG exports to Europe in the first four months of 2022, resulting in Europe surpassing Asia as leading destination for US LNG exports. The question now is how long and whether the US can continue supplying the bulk of its LNG to Europe due to a stronger gas demand from Asian countries as their economies reopen. Diversification of gas supply sources while moderating gas demand will be a key strategy for Europe to ease and tackle the energy crisis.

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.