As the Ukrainian conflict unfolds, Europe’s energy dependence on Russia becomes an increasingly critical bargaining tool. The economic sanctions imposed by some Western nations in response to Russia’s invasion appear to be increasingly directed against Russian oil and gas supplies and could result in severe consequences for the global energy market. The humanitarian cost of these tragic events is incomprehensible, and the shift in the global energy supply could potentially impact the livelihoods and finances of consumers, small and large businesses, as well as the oil and gas industry in both the East and the West via a complex interplay of supply and demand.

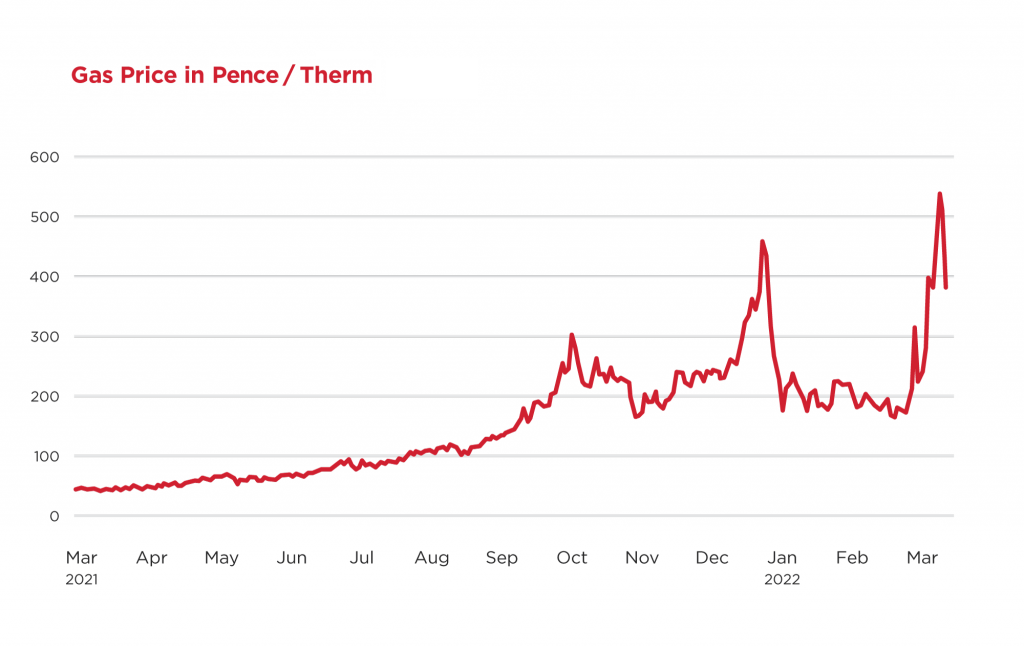

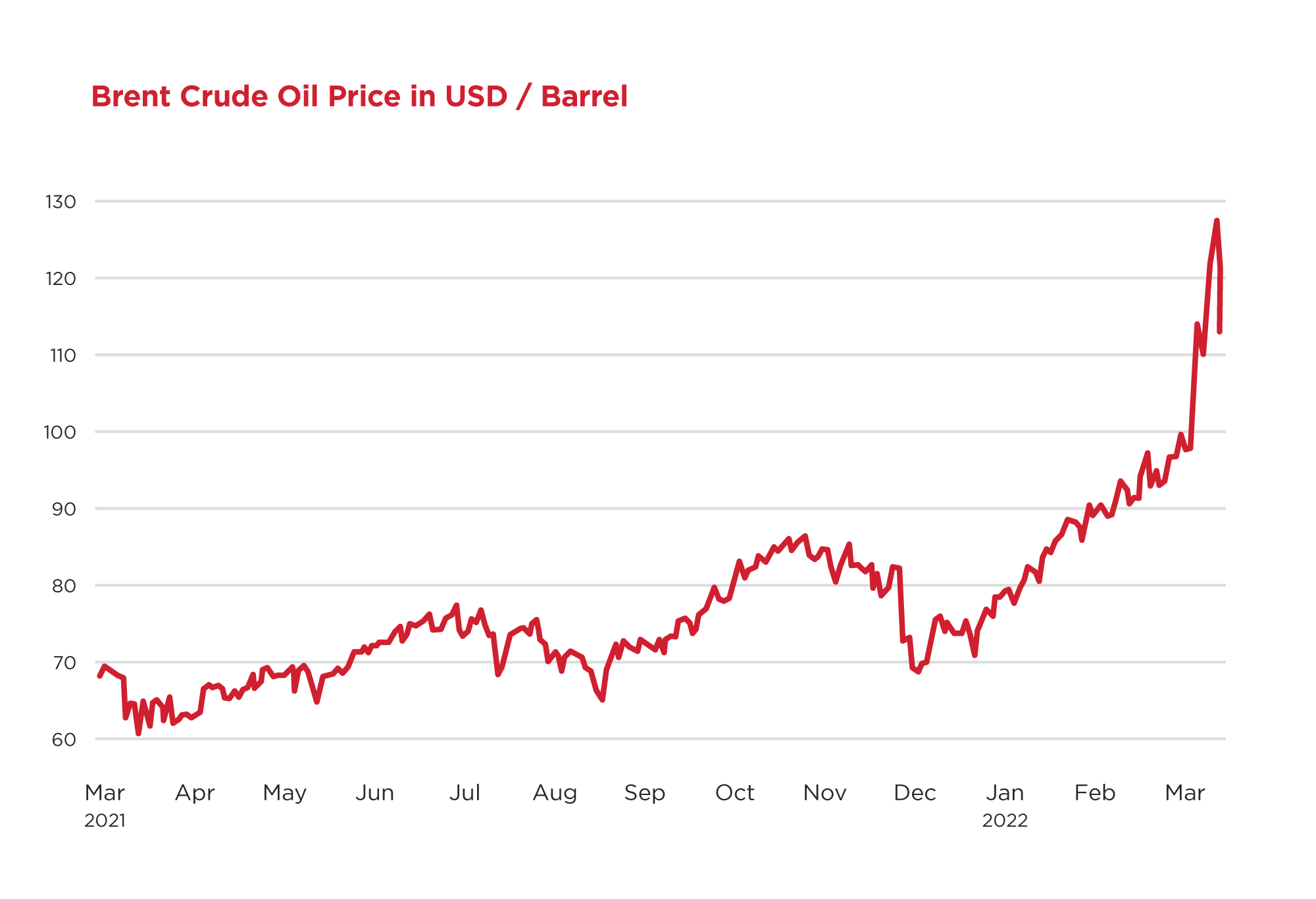

In response to the West’s increasing rejection of its oil, Russia threatens to disrupt the gas supply to Europe. Against the backdrop of heightened economic activity following the pandemic, low gas storage levels and high carbon prices, the world has already faced an energy crisis with soaring prices. In early March 2022, natural gas prices reached record heights of more than 500 pence per therm compared to prices of around 180 pence per therm one month earlier and 45 pence per therm one year ago [1]. Likewise, oil prices were soaring above USD 120 per barrel compared to USD 92 per barrel one month ago and prices of between USD 60 and USD 70 per barrel in March 2021 [2].

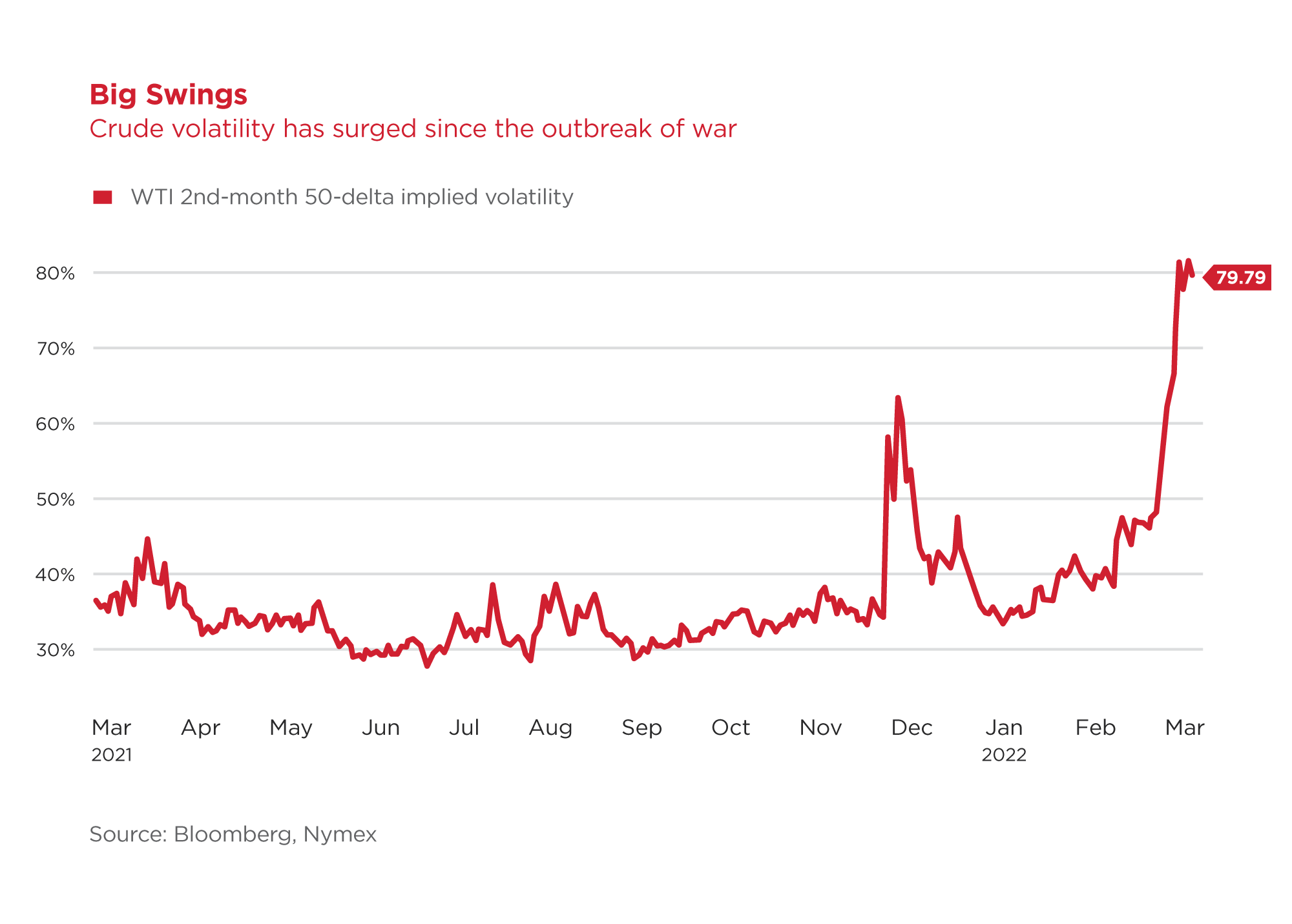

The impact of geopolitical decisions is significant volatility in oil and gas prices. On 9th March alone, the oil price rose to over USD 130 per barrel, only to close at around USD 105 per barrel, following news that the UAE called for OPEC members to increase output. The chart below shows how volatile the crude market has become in recent weeks.

This volatility arises because Russian oil and gas represent a significant proportion of supply to Europe and Asia Pacific countries and the removal of that supply leads to an imbalance in the supply and demand for these fuels.

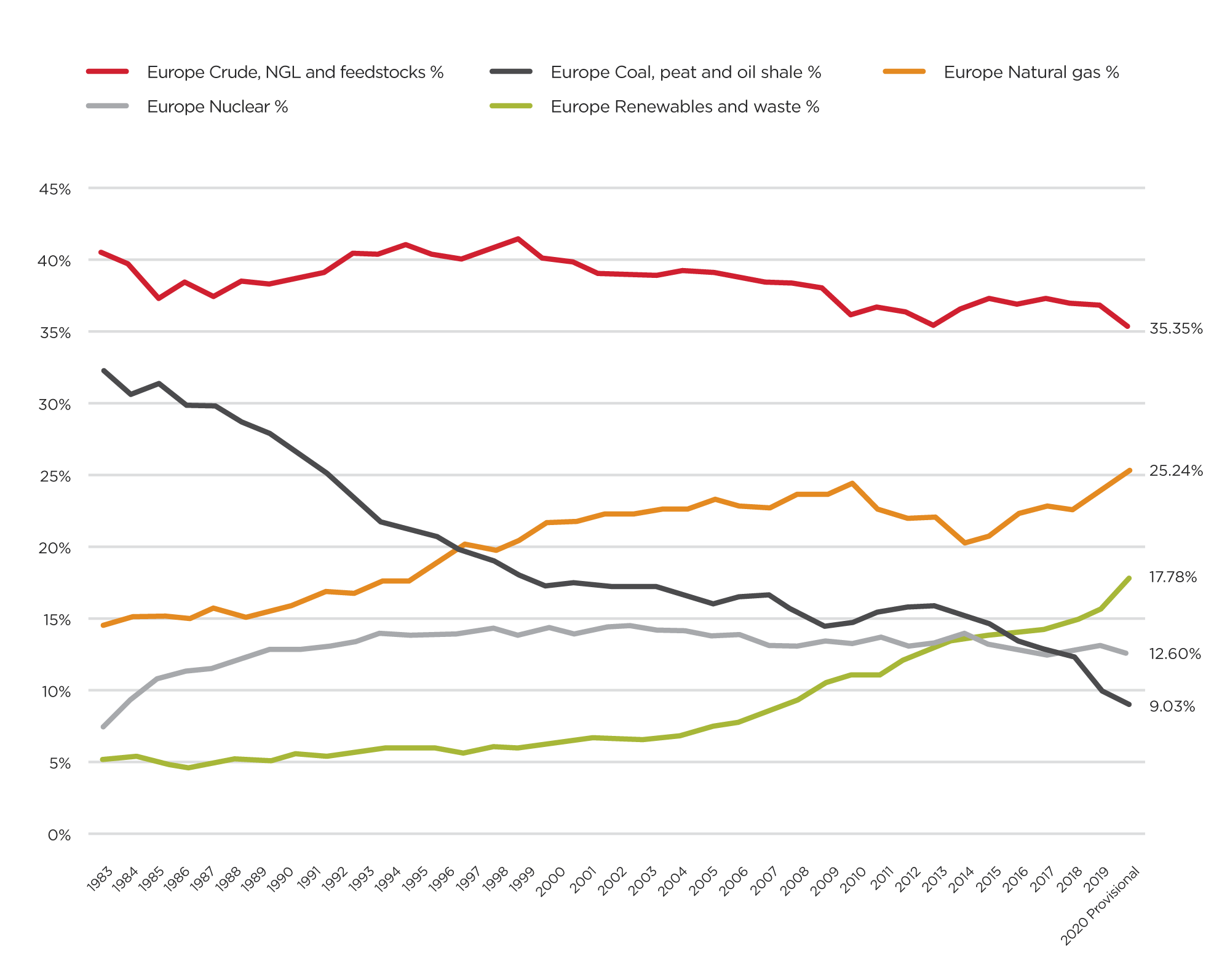

In the last two decades, Europe has driven a global focus on reducing greenhouse emissions and the shift from carbon-intense coal towards gas and green energy supply, as demonstrated in the below graph [3]:

Around 40% of the EU’s gas supply is imported from Russia, mainly via the Yamal, Ukraine Transit and Nord Stream 1 pipelines [4]. This interdependency would deepen under Germany’s original pre-crisis plan to double its gas imports via the planned Nord Stream 2 pipeline. In 2020, Russia exported 72% of its natural gas to OECD Europe, of which Germany (16%), Italy (12%) and France (8%) were the biggest recipients [5]. The remainder of Russian gas exports went to Asia and Oceania (11%) and non-OECD Europe and Eurasia (17%).

Russia is the third-largest producer of crude oil, after the USA and Saudi Arabia, exporting more than 40% of its production in 2021, with the distribution being around 50-60% to Europe and about 40% to Asia Pacific countries (mainly China).

Replacing Russian oil and gas is not an easy task, but the European Commission recently responded with its REPowerEU plan to end the reliance on Russian energy by 2030. The program entails increased gas imports from Norway, the UK and the Netherlands and more LNG imports from the US and other suppliers. At the same time, the shift towards green energy is likely to accelerate in Europe with a ramp-up of renewables, biogas and hydrogen. The plan would also entail increased use of coal in some nations while the alternatives are being established. This would allow Europe to end its dependency on Russian oil and gas and reduce CO2 emissions in the long run. In the short run, however, carbon emissions may rise, leading to higher CO2 emissions and potentially higher costs associated with the EU’s and UK’s Emissions Trading Schemes. Volatile oil, gas, electricity, and emission prices directly impact the margins of European and global energy producers as well as various other industries.

What does this mean for business interruption claims? The effects of the energy crisis and the ever-changing developments in fuel supply on future claims would require detailed analysis. When it comes to refineries and petrochemical plants, price volatility can certainly lead to volatility in margins, but higher prices do not always lead to higher margins and vice-versa. Stay tuned for our next technical briefing which will discuss refining and petrochemical margins for business interruption losses in greater depth.

By Kat Wilson and Phillip Taylor.

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.