The use of Linear Program models is common in refining, and other industries, to optimise their activities by using an algorithm subject to a set of inputs, constraints, and relationships. This article discusses the LP models in more detail and follows on from the recent case study which touched upon the use of LPs to value a business interruption claim.

What is an LP?

A Linear Program (“LP”) is a mathematical model used to optimise an objective function or target, containing a range of variables subject to a set of linear constraints and relationships. The objective function is usually defined as revenue, cost or margin and the objective is either to find the maximum, minimum or a specific value for the defined objective.

The most common refinery Linear Programming software utilised in the industry are:

- Honeywell Refining and Petrochemical Modelling System (RPMS);

- Aspen Technology Process Industry Modelling System (PIMS); and

- Haverly Systems Generalized Refining Transportation Marketing Planning System (GRTMPS).

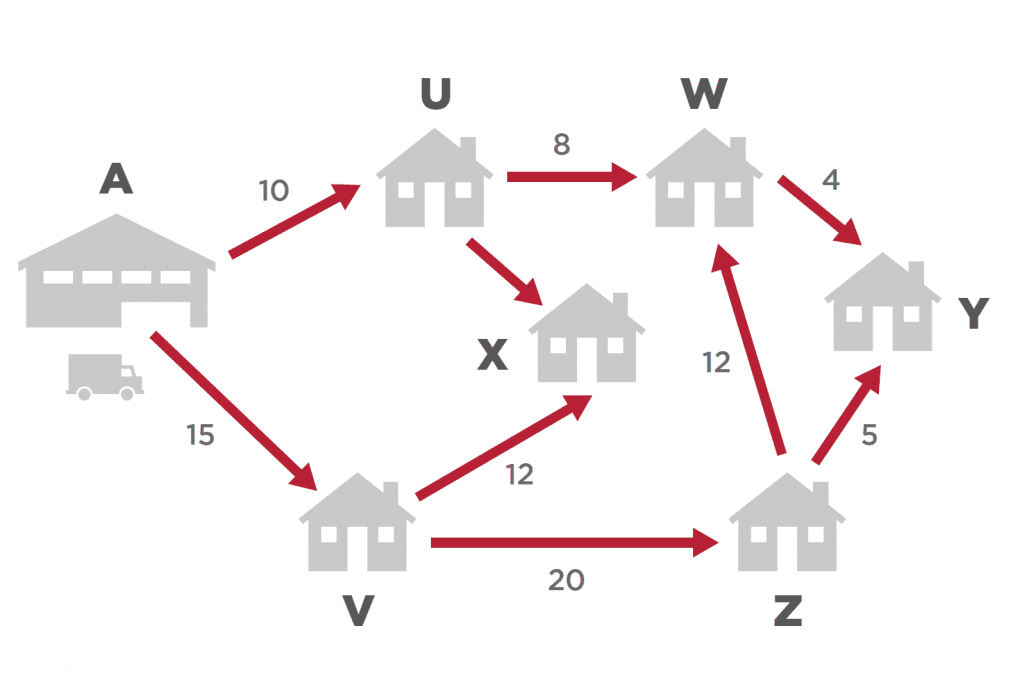

Although linear programs are frequently used in the oil and gas sector to determine the crude to purchase or how to operate the refinery given a set of operational constraints, they are also commonly used in the logistics sector. In the simplest form, an LP model can assist couriers that need to visit many locations in the shortest distance and time to complete deliveries, which might be experienced in the following scenario:

Other applications of linear programs include:

- Transportation – Airlines will typically use an LP model to optimise their profits according to seat prices and customer demand.

- Manufacturing – To maximise profit, a company may utilise an LP model to determine how much raw material to consume and the constraints each production unit has to optimise its output.

- Agriculture – An LP can be used to determine the type and quantity of crops to plant to maximise revenues from fields.

In essence, the LP can assist in finding the solution that generates the most money. Whilst an LP is commonly used in several industries and applications, this paper will focus on the use of LPs in an oil refinery. It should be noted that to fully understand the workings of the LP model, and the interaction between the inputs and outputs, we would typically work in conjunction with a chemical process engineer.

Use of LPs in the Refining sector

Refineries are complex operations, and multiple decisions need to be made, such as which feedstock to purchase, which products to produce, amongst other operational and financial decisions, which frequently change due to seasonal demand, changing margins and plant availability. Linear programs are a reliable tool for making these decisions.

The main uses of linear programming in a refinery include:

- Term Plans – Whether this is for annual budgeting purposes, term crude contracts or maintenance shutdown planning, the refinery will run term plans to have a view of the expected profitability during a longer-term time horizon. When running the term plans, certain assumptions must be made, including market demand, projected costs and prices, and expected plant availability and throughput levels. This LP provides a good overview of how the refinery should operate, given expected market conditions.

- Crude Oil Evaluation – Typically, a refinery will place crude oil purchase orders two to three months before delivery. Refineries generally operate with a base load of crudes, subject to availability and price, but the crude slate can vary due to seasonality, crude / product price differentials and the desirability of specific crude characteristics to yield production goals. Contracted crudes have minimum and maximum take-up volumes and decisions are needed on the level of take-up, which is where the LP model assists.

- Production Planning – Refineries will run an LP model to determine the best operating mode to maximise their margins in a given month. The inputs to the production plan are typically finalised towards the end of the month before the target month and will be based on the available crude and most current market demand and processing unit availabilities.

- Strategic Plans – This will include running LP models to determine the viability of expanding the refinery or revamping any process units.

Inputs and Outputs of an LP model

Although a large array of inputs are required when running an LP model, three critical tables must be completed for the LP to optimise and determine the economic function. These tables include:

- Buy – In the table Buy, refineries will input data related to the crude and other feedstock volumes and prices of the feedstock purchased.

- Sell – In this table, refineries will input the production demand based on the fixed/contractual agreements (fixed-grade) or non-fixed/expected demand (balancing or free grade). The LP optimises the production based on the product’s price, subject to any minimum or maximum demand constraints.

- Caps – The Caps (or capacities) table is where the minimum and maximum operational constraints of the process units are set. Any units which are out of operation or forced to run at reduced capacity should be specified in the LP model to avoid unrealistic results.

From the above inputs, the LP model will optimise and generally provide the following information in terms of output to achieve the optimal solution:

- Feedstock Purchases – the mix of crudes and other inputs to use and the throughput level

- Product Sales – the mix of output expected

- Utility Purchase/Sale – the requirement for electricity and steam not produced internally

- Capacity Utilisation – the level at which each unit should operate

- Process Capacity Limit

- Economic Summary Analysis – the revenue, variable cost and gross refining margin

The above allow refineries to determine the most effective operational mode and the financial results expected.

LPs in a Business Interruption claim:

Given the complexities of an oil refinery, it is not unusual for an Insured operating in this sector to prepare a business interruption claim based on the output of their LP model. If an Insured chooses to prepare a business interruption claim on this basis, due consideration has to be given to the evaluation of alternative crude oil purchases and monthly or rolling production planning, as these are directly pertinent to the business interruption calculation.

When two LP models (Standard, no loss scenario and Actual, loss scenario) are utilised to estimate a business interruption loss, the inputs for prices and constraints should be identical in both LP models except for those related directly to the damage.

The key considerations when running an LP model for the purposes of a business interruption claim are as follows:

- Unit capacities – Standard and Actual LP models should be run with the same unit capacities other than those directly affected by the business interruption.

- Crude – The crude slate should be restricted to the crude oils processed at the refinery and crude distillation capacity. Crude pricing should be the same in the Standard and Actual LP models otherwise, artificial differences are introduced, which affect optimisation and consequently the comparison of Standard and Actual LP models.

- Imports – Including imports affects optimisation and the comparison of Standard and Actual LP models, and we believe that imports should be considered in an off-LP model calculation.

- Markets / Sales – Fixed sales represent known contractual commitments and should be the same in Standard and Actual LPs. Open sales should be restricted at historically observed rates. Refined product pricing should be the same in the Standard and Actual LP models to avoid artificial differences being introduced.

- Stocks – These are typically considered in an off-LP model calculation if the consideration of stock is necessary.

To quantify a business interruption loss using LPs, a substantial amount of historical operational and financial documentation is analysed to determine how the refinery would have operated and the product outputs it could have achieved had the loss not occurred. With the assistance of an LP engineer, the inputs and constraints deemed most appropriate based on the data analysis would be discussed with the Insured to run the LP models. Once the LP models have been run and validating the input utilised, we examine the outputs to budgeted and historical actual data to ensure that the LP model output is aligned with our expectations.

As the LP is a mathematical model, reaching an early agreement on the inputs is vital. A small change in the LP model inputs and constraints can significantly impact the result.

Whilst agreeing the inputs to the LP model is vital, it is also important to examine the outputs. This can be done through the means of verifying the historical throughput and yields to those in the LP model or validating the Gross Refining Margin.

The Gross Refining Margin and Gross Profit of a refinery can be complex and have their nuances and will be the subject of a future technical briefing.

The statements or comments contained within this article are based on the author’s own knowledge and experience and do not necessarily represent those of the firm, other partners, our clients, or other business partners.