Introduction

In this technical briefing, we aim to provide an update on key Oil and Gas market indices and discuss whether we have moved past the significant volatility experienced between 2020 and 2024, or if the uncertainties persist in the market. This discussion is particularly relevant given the ongoing / increasing tensions in the Middle East, the potential implementation of tariffs and the uncertainty of many of the world’s economies.

In light of these uncertainties, we will also discuss the Volatility Clause and its evolution into the latest version, LMA5515A. We will highlight a key difference from the previous LMA5515 version and provide loss examples to illustrate the potential impact of the updated wording.

Recent Market Trends

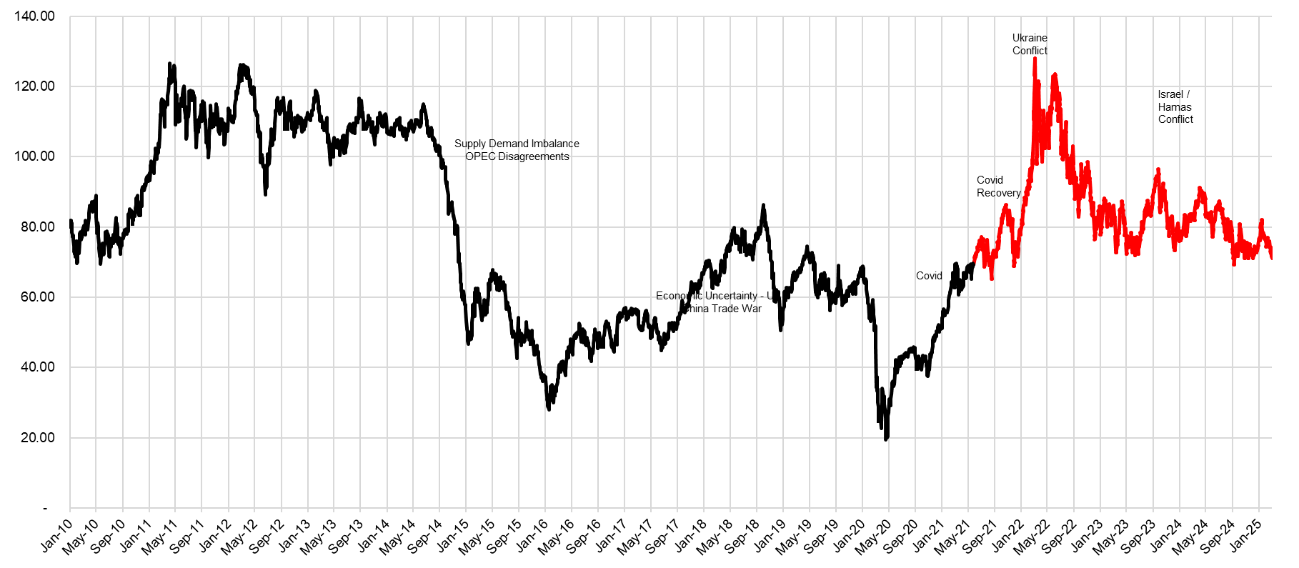

Since 2020, the oil and gas sector has been extremely volatile. For instance, Brent Crude prices surged from a low of USD 20 per barrel in March 2020 to a high of USD 120 per barrel in June 2022, reflecting a sixfold increase in just over 24 months.

Since the June 2022 high, Brent spot prices have declined and reached a new normal of approximately USD 80 per barrel by late 2023. The subsequent price fluctuations have been minimal, as illustrated in the following chart.

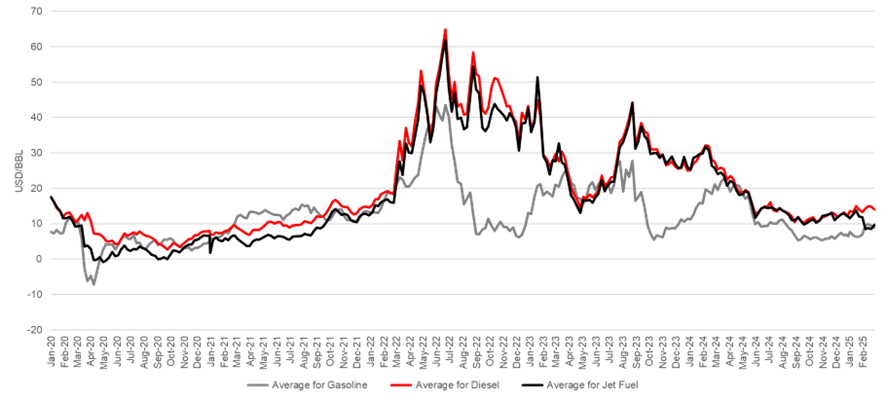

We have also included an extension of crack spreads (the price difference between refined products and crude oil) for the more recent period in the following chart.

The crack spreads followed a similar trend to Brent crude prices, plunging during the pandemic and then surging significantly in 2022. They have generally stabilized since late 2023. Notably, gasoline crack spreads had underperformed compared to diesel and jet fuel. Businesses reliant on diesel and jet fuel must continue operations to meet the demand in transportation, logistics and aviation. In contrast, gasoline demand has lagged due to the shift towards hybrid work environments and the ongoing transition to electric vehicles (EVs).

However, we are now entering a new phase of potential volatility with rising tensions in the Middle East, potential tariffs imposed by the Trump administration, a global economic downturn, and OPEC countries looking to increase market share through higher production. The question remains: will oil prices stabilize around USD 80 per barrel, or will global events reignite volatility?

Sum Insured

From an overarching principal, there are significant benefits to all parties involved in setting the correct sum insured, for instance:

- Insured – Ensures sufficient funds to recover losses

- Insurer – Allows for an accurate premium that reflects the associated risks

- Broker – Secures the correct commission while meeting clients’ expectations in the event of a loss

While this may seem straightforward, achieving the correct sum insured can be challenging, particularly in volatile markets. However, it is precisely during such periods that the insurance market must ensure sums insured are adequately set to avoid surprises for any party involved.

Several mechanisms are in place to help establish the correct sum insured:

- Forward-looking assessments – instead of relying on historical data, commodity price tracking or forward-looking pricing curves can offer a more accurate reflection of future risks, though they may still fall short of real-world conditions.

- Regular asset valuation in response to changes in market conditions.

- Frequent updates to brokers and underwriters to keep all parties aligned with the current risk environment.

At MDD, our experts can collaborate with companies to verify the necessary documentation and assist in preparing accurate sum insured values. Reporting the correct sum insured is essential to help businesses align with the Volatility Clause, ensuring they maintain adequate coverage, even in highly fluctuating market environments.

Volatility Clause

With the Average Clause increasingly being removed from insurance policies, the Volatility Clause was introduced with the aim of protecting insurers against the risks associated with incorrect sum insured values and significant market fluctuations.

On 11 September 2019, LMA5383 was published, making the introduction of the initial Volatility Clause. A little over a year later, on 27 November 2020, LMA5515 was introduced. However, a key complication arose when the Insured experienced a partial interruption, as there was no mechanism to adjust the volatility cap accordingly. As a result, the clause could not provide the intended protection for insurers.

To address this issue, which Insurers found unsuitable for partial losses, LMA5515A was published in March 2024. This updated clause focuses on targeting the policy’s indemnity exposure in the following manner:

- For interruptions equal or less than 10 months from the date of Damage, the Calendar Monthly Cap applicable to each monthly period of the interruption shall apply

- For interruptions greater than 10 months from the date of Damage, the Annual Cap shall apply on a pro-rata basis

- Following Damage, if the (Re)Insured is able to continue / resume with partial operations at the Location(s) suffering Business Interruption loss, then the Caps calculated in 1.1 and 1.2 shall be proportionately reduced by the amount that the Actual Business Results achieved from the partial operations bears as a ratio to the total Expected Business Results at the Location(s) suffering Business Interruption loss. For the avoidance of doubt, the Expected Business Results and Actual Business Results are individually calculated for each Calendar Month or Annual period for which a Cap is to be applied. (Bold by MDD)

The above means that the cap will be adjusted based on a proportionate comparison of the Expected and Actual Business Results, as shown below:

To put this concept into practice, we have applied both LMA5515 and LMA5515A in the following theoretical loss calculations to demonstrate their impact on our loss measurement:

Loss Example 1 Details:

- Date of loss: 1 January 20XX

- Impact: 50% of production impacted

- Indemnity Period: 6 months (max IP 12 months)

- Deductible: 30-day waiting period

- Volatility Clause: 120% of the annual and monthly sum insured.

- Sum Insured: USD 500 million

Since the loss period is less than 10 months, the Volatility Clause directs us to adopts the monthly cap, which equates to USD 50 million (USD 500 million / 12 months x 120%). Under LMA5515, there is no adjustment for partial losses, so we simply compare the USD 50 million cap to the estimated monthly loss to determine whether the monthly cap applies.

Conversely, under LMA5515A, a partial loss adjustment factor is applied (for the purposes of this example, we assume a 50% production shortfall, which directly correlates to a 50% reduction in business results). Therefore, we compare the proportionally adjusted monthly cap (USD 50 million x 50% impact = USD 25 million) to the estimated monthly loss values.

The results of this comparison are summarised in the following table:

| Period | Monthly Loss | LMA5515 | LMA5515A | ||

| Volatility Cap | Net Loss | Volatility Cap | Net Loss | ||

| USD m | USD m | USD m | USD m | USD m | |

| M1 | Waiting Period | Waiting Period | |||

| M2 | 27.0 | 50.0 | 27.0 | 25.0 | 25.0 |

| M3 | 40.0 | 50.0 | 40.0 | 25.0 | 25.0 |

| M4 | 43.0 | 50.0 | 43.0 | 25.0 | 25.0 |

| M5 | 37.0 | 50.0 | 37.0 | 25.0 | 25.0 |

| M6 | 31.0 | 50.0 | 31.0 | 25.0 | 25.0 |

| Total | 178.0 | 178.0 | 125.0 | ||

As illustrated above, the impact is significant, exceeding USD 50 million. It is important to note that the adequacy of the sum insured, if calculated, is approximately 45%.

However, it should be noted that the impact may not be that significant if the sums insured are set correctly and regularly updated to reflect current market conditions. In such cases, the impact may be negligible.

Loss Example 2 Details:

- Date of loss: 1 March 20XX

- Impact: 20% of production impacted

- Indemnity Period: 7 months (max IP 18 months)

- Deductible: 30-day waiting period

- Volatility Clause: 120% of the annual sum insured and 130% of the monthly sum insured

- Sum Insured: USD 360 million

Similar to Loss Example 1, the loss period is less than 10 months, leading us to determine a monthly cap of USD 26 million (USD 360 million / 18 months x 130%). In this example, we assume a 20% production shortfall, translating to a 20% reduction in business results. While LMA5515 does not adjust the cap for partial losses, LMA5515A accounts for them, yielding a proportionally adjusted monthly cap of USD 5.2 million (USD 26 million x 20% impact). We then compare this cap or adjusted cap to the estimated monthly loss values.

The results of this comparison are summarised in the following table:

| Period | Monthly Loss | LMA5515 | LMA5515A | ||

| Volatility Cap | Net Loss | Volatility Cap | Net Loss | ||

| USD m | USD m | USD m | USD m | USD m | |

| M1 | Waiting Period | Waiting Period | |||

| M2 | 4.5 | 26.0 | 4.5 | 5.2 | 4.5 |

| M3 | 5.0 | 26.0 | 5.0 | 5.2 | 5.0 |

| M4 | 3.5 | 26.0 | 3.5 | 5.2 | 3.5 |

| M5 | 3.8 | 26.0 | 3.8 | 5.2 | 3.8 |

| M6 | 4.2 | 26.0 | 4.2 | 5.2 | 4.2 |

| M7 | 4.0 | 26.0 | 4.0 | 5.2 | 4.0 |

| Total | 25.0 | 25.0 | 25.0 | ||

As illustrated above, there is no adjustment to the estimated monthly loss under either clause. If assessed, the adequacy of the sum insured would be approximately 90%. However, with the allowed uplift of 30%, the cap remains well above the estimated monthly loss, ensuring full indemnification of the total loss to the insured.

Conclusion

In recent years, the energy market has witnessed extreme fluctuations, with oil prices swinging dramatically from the lows of 2020 to a significant surge in 2022. While market conditions have somewhat stabilized, ongoing global tensions and economic uncertainties could reignite volatility.

In this unpredictable landscape, LMA5515A introduces timely enhancements to insurance coverage, while allowing for the flexibility necessary in a rapidly changing world.

The key benefits are summarised below:

- A more balanced approach for assessing partial loss scenarios

- Enhanced protection for insurers when the sum insured is adequate

- A level of flexibility for the Insured to manage the unpredictability of market conditions through the use of uplift percentages